Key takeaways

- Many economists believe there will be a recession in the next year or so.

- The Federal Reserve, the country’s central bank, is intentionally slowing the pace of economic growth, which is hard to do with precision.

- The housing market and job market are both so strong that the Federal Reserve (Fed) will likely have to keep raising interest rates, which could cause a downturn.

If you have no idea what’s going on in the economy, you’re not alone. The “experts” whose job it is to forecast economic trends are also uncertain. In one recent survey, for example, the well-regarded National Association of Business Economists (NABE) said its members hold “a variety of opinions on the fate of the economy – ranging from recession to soft landing to robust growth.”

But while there are divisions over when it will start and how bad it will be, most economists (including NABE’s) do believe the United States will enter a recession this year. As you may know, the Federal Reserve, the country’s central bank, is intentionally working to slow the economy from its superheated period of post-pandemic growth, and it’s very hard to gently tap the brakes on something as large and complex as the U.S. economy.

With that in mind, here’s an overview of what the professionals are keeping an eye on, and what that information is telling us now.

Jobs

One of the most important components of economic activity is work: how many people are employed, what kind of wages they’re making, and what industries they’re involved in. Right now, all the information we have about jobs says the economy is on fire.

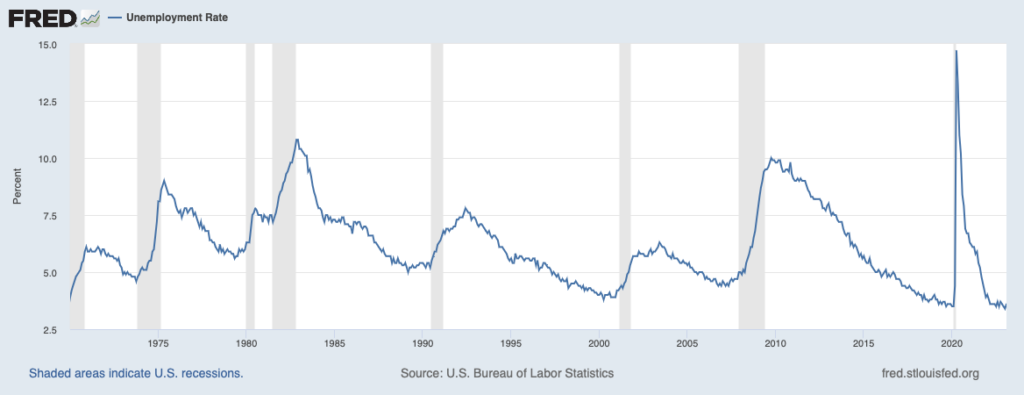

Companies hired more than 300,000 people in February, outpacing expectations, while the unemployment rate ticked up slightly to 3.6 percent – still a low rate. What’s more, companies are laying off very, very few workers.

The current health of the job market is important because it suggests that if we do get a recession, it won’t be as severe as some past downturns. In NABE’s most recent survey, most members said they think the jobless rate will peak at 4.9% over the next 12 months — compared to a high of 10% during the 2007-2009 recession.

Housing

The housing market is so integral to the overall economy that some researchers consider the two synonymous. Most people need to be employed – and have confidence that they’ll have a job for the foreseeable future – to feel comfortable taking on a mortgage and the upkeep that comes with homeownership. Also, banks need to be lending at reasonable rates for the mortgage market to function well. Neither of those conditions apply when the economy is on the skids.

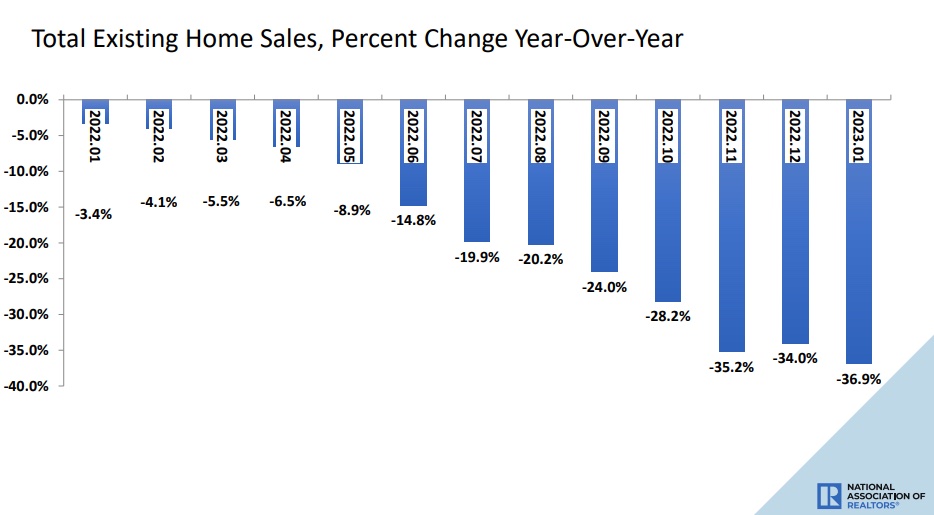

Recently, we’ve had the opposite problem: the economy has been too hot, not too cool. So, in 2022, the Fed began to raise interest rates to dampen demand.

For a while, that seemed to work. Home sales tumbled and prices flatlined.

But more recently, housing has started to rebound. A measurement of home-contract signings has surged for the last two monthsin a row. Also for the last two months in a row, homebuilders have reported more prospective buyers visiting their sites. Both suggest stronger sales activity could be coming.

Credit conditions

The Federal Reserve influences the economy by raising or lowering interest rates for banks. While the Fed doesn’t directly control mortgage rates, its work ultimately influences them. And that’s probably the best example for illustrating their work: fewer people are able (or willing!) to swing a 6% mortgage than one at 3%. So: rates go higher, people back away, and economic activity slows.

But the Fed isn’t the only player in the lending business. Individual banks may decide they’re too worried about the economy to lend lots of money. Or they may keep lending, but tighten their requirements for borrowers, which has the same effect.

That’s exactly what’s going on now. Every month, the Fed surveys banks to gauge lending conditions. In January, it reported, “Banks, on balance, reported expecting lending standards to tighten, demand to weaken, and loan quality to deteriorate across all loan types.”

Summary

It’s important to keep in mind that recessions don’t just happen for no reason. They’re not inevitable after a certain period of time, and even the smartest economists can be stymied by unpredictable events — like the COVID-19 outbreak in 2020.

And one of the surest ways for a recession to happen is for the Fed to cause it. As noted above, the central bank has been trying to calm the economy down, to bring demand down to earth after years of turbo-charged growth. Most economists, and most businesses that make money based on the Fed’s actions (like banks), are looking at the strength in areas like housing and the job market and concluding that the central bank’s work is not yet done.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”