The smart way to access

home equity.

With an Unlock HEA, you receive cash up front in exchange for a portion of your home’s future value.

Unlock has helped more than 12,000 homeowners

access their home equity

How it Works

Get your estimate.

Apply.

Receive an offer.

Get funded.

Compare Your Options

|

|

Home Equity Loan

|

HELOC

|

Cash-Out Refinance

|

Reverse Mortgage

|

|

|---|---|---|---|---|---|

|

Minimum Credit Score

|

500

|

700

|

680

|

580

|

None

|

|

Debt-to-Income

|

N/A1

|

43%

|

43%

|

50%

|

N/A

|

|

Loan-to-Value

|

80%

|

90%

|

85%

|

80%

|

60%

|

|

Fine Print

|

Must maintain property, pay taxes, home insurance and first lien mortgage (if applicable)

|

Defaulting on your loan or missing payments could cause you to lose your home to foreclosure.

|

Variable monthly rate. Penalties for inactivity, required balance

|

30 to 60 days to close, interest rates higher

|

Must pay taxes, insurance and live in the home. Age restrictions

|

Questions?

We Have Answers

Yes! If you have a mortgage, you should have significant equity in your home to qualify – typically about 40%.

Unlock requires you to maintain hazard insurance equal to the replacement cost of your home. Unlock must continue to be named on all property insurance policies as a “mortgagee” and/or “additional interest” throughout the term of your HEA.

Yes, as long as the trustor lives in the home as their primary residence, and all trustees and trustors sign the home equity agreement at closing.

An Unlock Agreement has no age requirements and can yield similar cash to a homeowner as a reverse mortgage. Unlike a typical reverse mortgage, you can take out an Unlock Agreement in addition to your first mortgage. In addition, a reverse mortgage is a loan and has an interest rate which increases the balance owed regardless of the home’s value. Over time it is possible for a reverse mortgage to consume all your home equity. An Unlock agreement is not a loan, is impacted by home value and does not consume all your home equity.

Once you create an account, we’ll provide an estimate of the maximum cash available.

In general, the maximum amount of cash available from Unlock is $500,000. The specific amount we can offer you depends on four things:

- Your home’s current value. In general, the more your home is worth, the more cash is available.

- Pre-existing housing debt. This includes all mortgages and credit lines secured by your home. In general, the less housing debt you have, the more cash is available.

- Your credit history. A good credit track record may qualify for more cash.

- The use of the property. We can typically offer more cash when the home is your primary residence.

Note that these factors can affect each other. For instance, an expensive home with a lot of debt may qualify for less cash than a less expensive home with no debt.

See the Unlock Product Guide for more details.

You do! Unlock secures its interest by placing a lien on the property but has no rights of occupancy. We do not go on title except in rare circumstances.

See the Unlock Product Guide for more details.

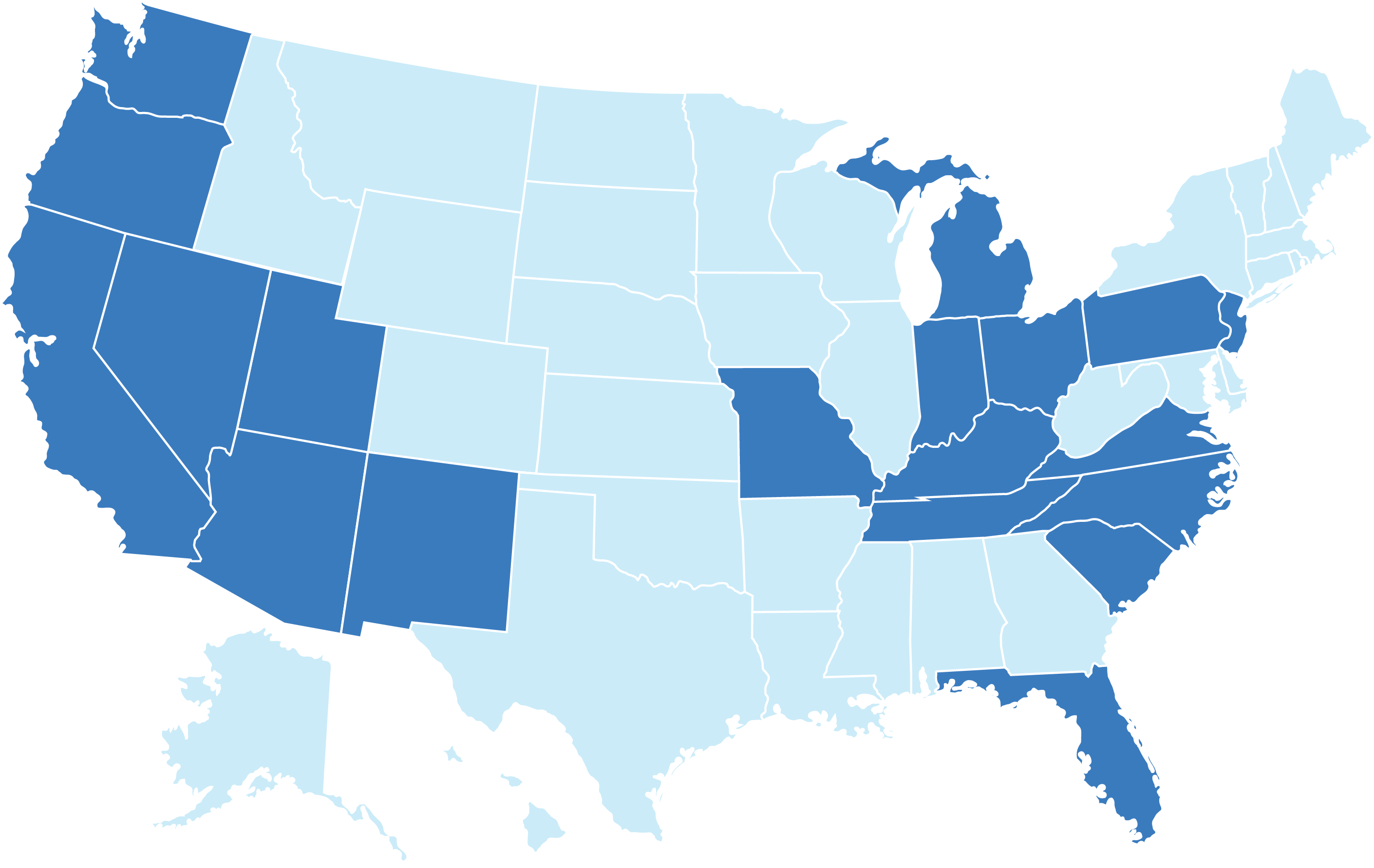

We are currently helping homeowners access their equity in Arizona, California, Florida, Indiana, Kentucky, Michigan, Missouri, Nevada, North Carolina, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Utah, Virginia, Washington.