We provide families simple

financial solutions.

Or a bank. We are a team of consumer finance, mortgage and real estate leaders helping the everyday American homeowner who has been left behind by the traditional home and finance system.

We enable homeowners to access home equity without getting a loan. This gives them greater flexibility and control over their finances allowing them to pay off high interest debt, make home improvements or pay for a child’s education.

Home Equity Pioneers

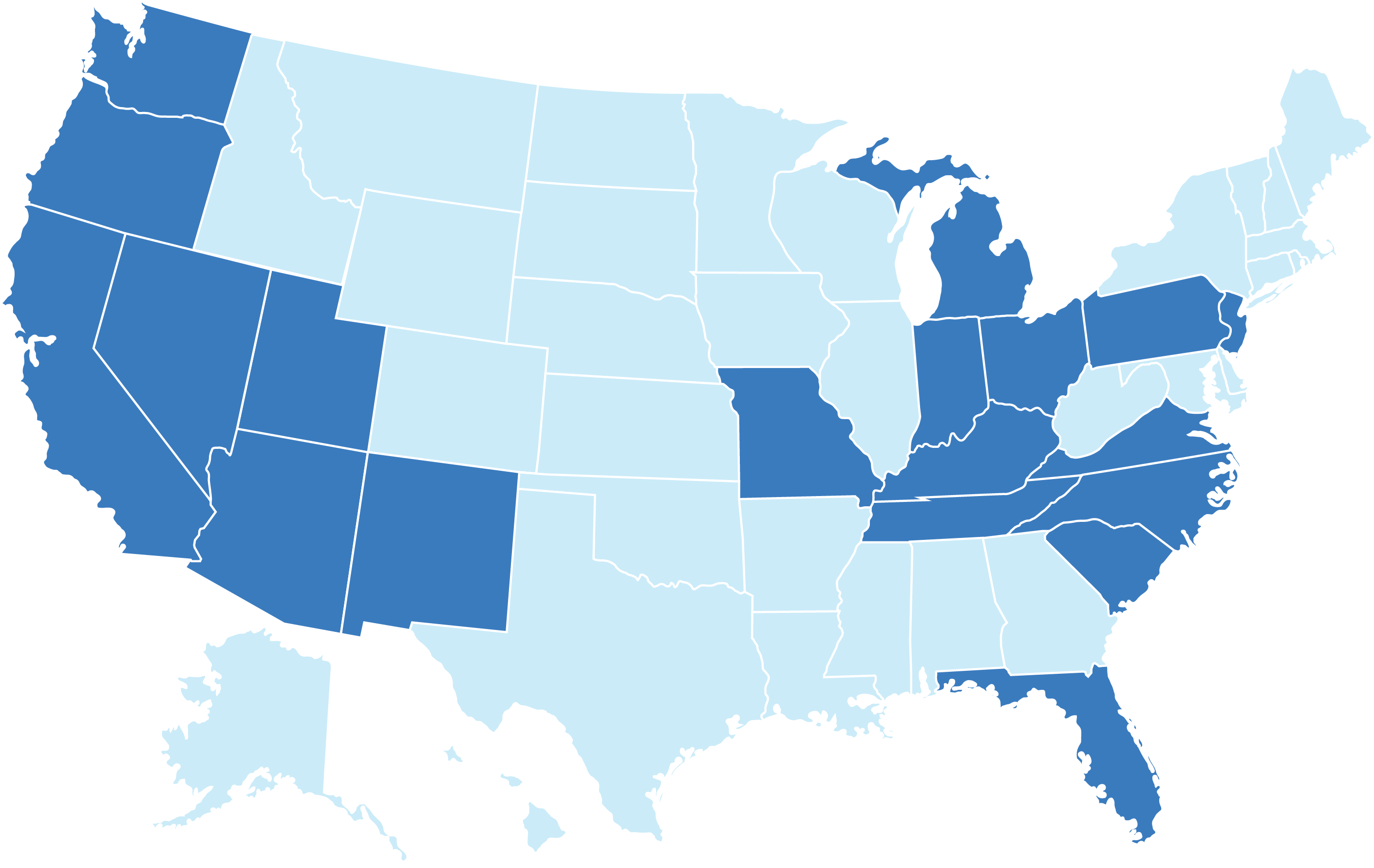

Unlock is helping homeowners access their equity in the following states:

Committed to supporting homeowners.

Jim Riccitelli

Jim Riccitelli

CEO & Co-Founder

Jim has over 20 years of experience in consumer finance, with a focus on product development, strategy, management, legal and regulatory, operations and business development. Before co-founding Unlock Technologies, he spent more than a decade as Co-CEO and President of Unison Home Ownership Investors, the pioneer in the Home Equity Investment industry. Jim was previously a senior executive at Nomura Holding America’s commercial real estate lending and private equity units, and a partner in an Arizona-based mortgage brokerage firm.

Jim holds Bachelor and Master of Science degrees in Computer Science from Iona College and an MBA from Columbia University with Beta Gamma Sigma honors. He is also a Chartered Financial Analyst.

Paul Tucker

Paul Tucker

Chief Operating Officer

Paul has more than a decade of experience driving strategic business operations at high volume technology companies. He brings a creative and innovative background to Unlock, having been a proven leader at Reali, Unison Home Ownership Investors, EY and Accenture. While at Reali, Paul helped develop and execute the plan to transition the company from a technology firm to a multi-product real estate company. At Unison, he was instrumental in standing up the business operations function, which accelerated product implementation and mitigated disruption across the organization. Throughout his career he has delivered meaningful enterprise business value through technology and analytics.

Paul holds a Bachelor of Arts degree from Rice University.

Kevin Nerney

Kevin Nerney

Chief Financial Officer & Chief Business Officer

Kevin has spent the last decade launching consumer finance products at venture-backed fintech companies. He served as general manager at LendingHome, Haus, and Unison Home Ownership Investors where he scaled teams, launched new consumer finance products with profit and loss accountability. Kevin is passionate about customer experience and building products that consumers will use and love. He started his career at PwC where he performed merger and acquisition due diligence for technology companies and private equity clients.

Kevin graduated from Cal Poly, San Luis Obispo. He is a licensed CPA in the state of California and a CFA charter holder.

Michael Micheletti

Michael Micheletti

Chief Marketing Officer

Michael has nearly two decades of experience in consumer finance, with expertise in consumer debt, financial behavior, and financial stress. Before he joined Unlock, he led Corporate Communications for Freedom Financial Network. He previously led communication and marketing teams at Unison Home Ownership Investors, H&R Block and MedExpert International. He also has served as news director and associate producer for iHeart Radio and as a communications advisor for early stage fintech startups.

Michael holds a Bachelor of Arts degree from California State University-East Bay and a master’s in integrated communications from Golden Gate University.

Peter Silberstein

Peter Silberstein

Chief Capital Officer

Peter is a capital markets expert with more than a decade of experience in capital formation and strategy. A FinTech and financial services industry veteran, Peter previously held various senior leadership roles at Pagaya Technologies Ltd., Figure, SoFi, Goldman Sachs, and Morgan Stanley. Most recently, Peter was the Head of Partnerships and Capital Development at Pagaya, where he led the business development and capital formation strategies leading up to the company’s initial public offering.

Peter earned a Bachelor of Science degree in Business Administration at the Marshall School of Business at the University of Southern California.

Heather Bailey

Heather Bailey

Chief People Officer

Heather is a veteran human resources executive with deep experience developing and building capital teams for organizations in the technology, healthcare, global finance, real estate and homebuilding sectors. She has held key HR positions with Offerpad, Banner Health, American Express and PulteGroup.

She earned her bachelor’s degree from Arizona State University and holds a certification in Strategic Human Resources Management from Cornell University.

Lee Kaplan

Lee Kaplan

General Counsel

Lee has nearly two decades of experience in the residential mortgage industry, directing risk management, compliance and legal functions for both public and privately held organizations. Before joining Unlock, Lee served as General Counsel and Chief Compliance Officer at Arc Home LLC, a leading non-agency mortgage lender, where he oversaw all legal affairs. He also spent 13 years at PHH Mortgage.

Lee holds a bachelor’s degree from Lafayette College and a J.D. from Temple University’s Beasley School of Law.

We are experts from a wide variety of backgrounds