Key takeaways:

- Interest rates just went up again, but the Fed said it would pause before making any more moves.

- Investors and analysts increasingly expect the economy to worsen enough that the central bank will have to cut rates sometime this year.

The Federal Reserve (Fed) raised interest rates again at its May meeting, but signaled it was done with rate hikes for a while, even as investors increasingly expect the central bank to reverse course and start cutting later this year.

When the Fed first started raising rates in 2022, inflation and the economy were overheated. Raising interest rates is a blunt way to cool demand, which then generally brings down inflation. One easy way to visualize that is in the housing market: when mortgage rates go up, fewer people can afford homes, so home prices don’t get bid up at the same pace — and in some cases, actually decline.

The catch is exactly what’s mentioned above: fewer people can afford homes or afford loans for starting a business or paying for big items like home renovations and major purchases. That doesn’t just dampen prices, it depresses economic growth, possibly causing job losses.

Analysts and investors have been watching nervously to see if the Fed can thread that needle this time. So far, the economy seems strong — but many economists believe there are early, concerning signs.

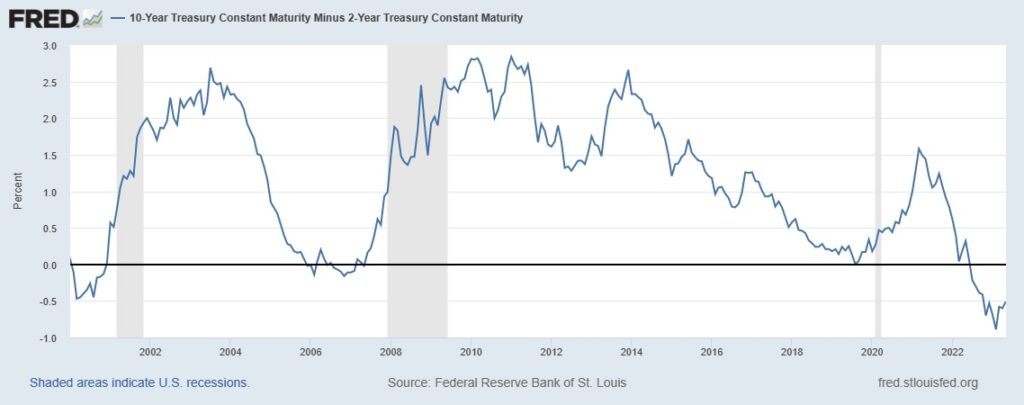

Among them, investors are demanding more money to buy shorter-term U.S. Treasury notes than longer ones, a sign that they expect near-term economic pain. That’s shown in the graph below: it dips below the zero line into negative territory when the normal dynamic goes backward. Every time it has happened in the past few decades, a recession (the shaded bars) has followed.

Source: St. Louis Fed

The recent spate of bank failures is another worrying sign. The banks that failed generally had made bad bets on the direction of interest rates, and when they lost money, it was because of poor governance, not because of an overall contagion in the financial system.

But that doesn’t matter to other banks, which panicked after their peers failed, and slammed their loan books closed. It’s still too early to know precise data, but anecdotal evidence suggests that bank lending has become much more restrained since mid-March, when Silicon Valley Bank and Signature Bank went under. That’s only likely to have worsened since the April 30 sale of First Republic Bank.

When banks aren’t lending, it has the same effect as when consumers can’t afford the rates they’re offering – it depresses economic activity. Meanwhile, lending is freezing up even as the interest rate hikes that were first put into place in early 2022 are continuing to ripple throughout the economy.

“Looking back in history, the median time it takes from when the Fed starts hiking until the unemployment rate bottoms and moves higher is 14 months,” wrote Torsten Slok, chief economist for the investing firm Apollo, in a recent analysis. “With the first Fed hike in March 2022, we should begin to see the unemployment rate increase within the next couple of months.”

Traders are betting that the central bank will cut rates as soon as this summer, a sign that they agree with that premise.

All of it adds up to a lot more nervous watching and waiting.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”