Key takeaways:

- The central bank just raised interest rates again, but this may be one of the last times it does so.

- When two large U.S. banks failed in early March, it was a sign that interest rate increases have done some damage to the financial sector.

- No matter what the Fed does now, most banks are likely to curtail their lending, which has the same effect as interest-rate hikes.

In late March, the Federal Reserve hiked interest rates, the ninth time it has raised borrowing costs since early 2022. But those rate increases may soon end, and there’s a strong possibility the Fed may start to cut rates instead. Here’s a closer look at what’s going on.

Since the start of the year, the central bank has downshifted, raising interest rates by only 25 basis points (.25%) each time rather than 50 or 75, as was the case throughout 2022.

Even if you know nothing about interest rates, it’s fairly intuitive that a slower pace of increases — tapering them off — is likely a signal that the Fed sees its work wrapping up. What’s less intuitive is why.

Taking time to trickle through

The Fed’s job is to bring stability to the economy, namely to prices (inflation) and to employment. When inflation spiraled out of control after the pandemic, the Fed had to raise the cost of borrowing sharply to rein in demand for goods, services, and workers. But it takes a long time for the central bank to recognize the problem, decide what to do about it, and then act on it. It takes even longer for those actions to trickle through to what’s sometimes called the “real economy.”

As we noted in January, the first time the Fed tapped the brakes on its rate-rise regimen, it was unclear how much damage those interest rate hikes had done. After all, the Fed doesn’t intend to derail the economy — as we just noted, its job is to protect it!

But at some point, tightening the screws on the economy starts to chafe. When people can’t afford a mortgage, the housing market starts to suffer. When businesses can’t get loans, workers lose their jobs.

And, occasionally, banks go bust. That’s what happened in March, when Silicon Valley Bank and Signature Bank were taken over by the government. To be sure, there were likely flaws in the management of those particular companies; banks in general don’t just go under when interest rates go up.

Stresses in the financial sector

But when institutions whose entire business model is based on taking advantage of interest-rate changes cannot manage them, it’s a clear sign that there are stresses in the financial sector.

More importantly, it causes most other financial institutions to become much more cautious. And by tightening up their lending practices, banks will start to do the Fed’s work for it. It won’t be higher interest rates keeping consumers from borrowing to finance purchases, it’ll be bank standards and guidelines doing it.

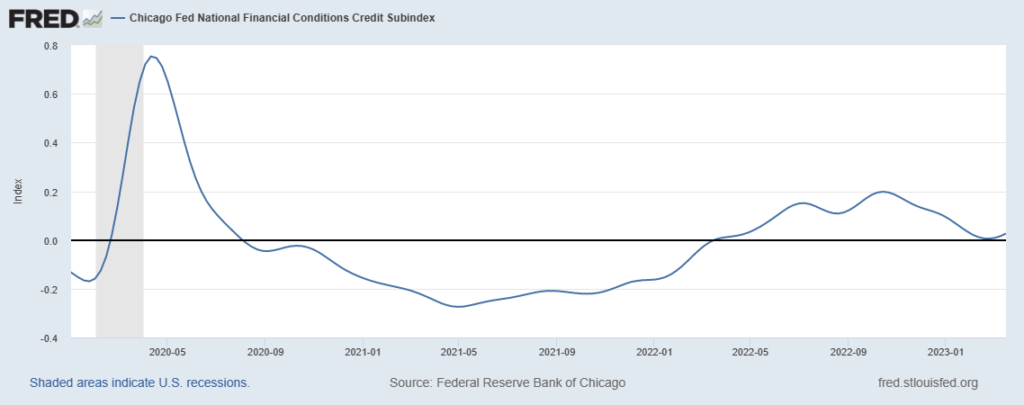

As of this writing, it’s only been a few weeks since those banks failed, but the chart below shows one measurement of how tight or loose financial conditions (lending) is. You can see the uptick on the right side of the chart, which is updated every week. (For some context, that sharp spike on the left was the height of the initial COVID panic, before the Fed stepped in and took emergency measures to stabilize the economy.)

Source: Chicago Fed, St. Louis Fed

As we’ve noted before, Fed watchers often talk about how the central bank always tries to engineer a “soft landing” for the economy, to bring demand back down to earth gently. The 2023 bank failures show things getting a lot bumpier than the Fed expected just weeks ago. Now we must wait to see how bad the turbulence gets and how much trickles through the economy.

The rate-rising cycle may have run its course for now. And if conditions get bad enough, rate cuts may be on the table instead.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”