Key takeaways:

- If you’re struggling to make your monthly mortgage payment, don’t panic, but do take action.

- There are multiple options for you and your mortgage company to consider.

- This is a good time to look for help from a housing counselor, lawyer or both.

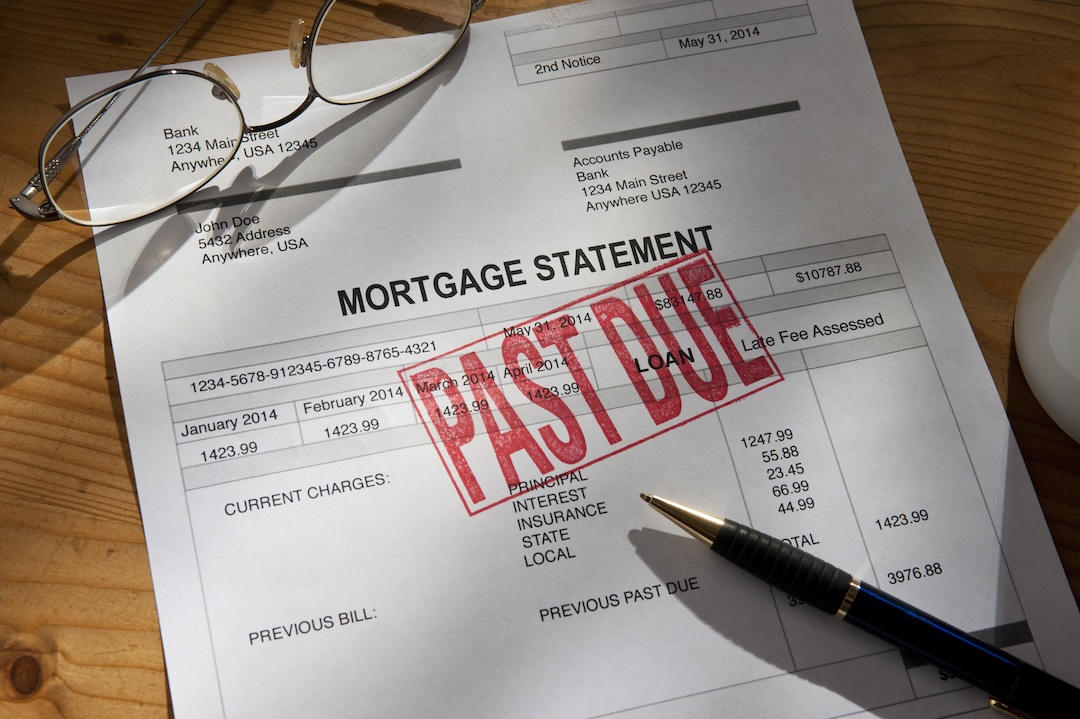

You have a budget, you have a job, and you have good intentions, but sometimes, life happens, and you struggle to make your mortgage payments. If you’re in that boat now and wondering how you’re going to keep up with your mortgage payments, don’t panic. There are options.

The first thing to do is call your mortgage servicer. The servicer — like a bookkeeper who collects payments, keeps track of your principal balance, and in many cases pays your property taxes for you — is sometimes, but not always, the original lender who gave you your loan. If you don’t know who is servicing your loan, the name can usually be found somewhere on your monthly statement.

If you’ve tried and you can’t find the servicer’s name, don’t panic. Use this online locator to find a HUD-affiliated housing counseling agency closest to you. HUD, the Department of Housing and Urban Affairs, has agencies in communities across America.

Even if you get in touch with your servicer immediately, it’s probably a good idea to contact a housing counseling agency anyway. We’ll discuss that in a moment.

Your servicer will want to know why you think you can’t make your monthly payment, and whether you expect it to be a temporary issue or a permanent one. You’ll want to have up-to-date information on your bank and investment accounts, income, and other financial matters.

If this seems intimidating, that’s understandable. Still, keep in mind that servicers have options to help people struggling to make mortgage payments. What’s more, it’s in their best interest to help you avoid foreclosure. The important thing is that you reach out and make a plan to address your finances. Don’t just ignore the problem and hope it will go away.

You should expect your servicer to review your situation and offer you options. While you’re doing that, now is the time to contact a housing counseling agency, if you haven’t already.

Housing counselors are trained to help ordinary Americans who are struggling to achieve, or keep, homeownership. They will review your situation and will likely also come up with a few options for you based on your finances and your expectations about whether your hardship is temporary or permanent.

Counselors can also help you work with your servicer during this period, making sure you understand the options they give you. They may even be able to help you challenge the servicer’s decisions if that becomes necessary. But they can also help you move forward — by developing a budget that considers your new financial profile, for example.

Important: even if you are generally financially savvy, this is one time when you might want to ask for help. There is a lot of outdated, incorrect, conflicting information on the internet that may trip you up. The federal government created programs to help Americans keep their homes in the aftermath of the 2008 financial crisis, and during the initial phase of the COVID-19 pandemic. In most cases, those programs and their protections have expired, but information about them lives on online.

What options are typically available today?

Your servicer and/or counselor may suggest you refinance your property to better align your monthly payments with your situation. Refinancing carries costs, though, and right now, interest rates are much higher than they have been for the past several years, so this may not be the best option for you.

Another option might be a loan modification, which is a structured agreement that changes the terms of your existing mortgage (in contrast with a refinance, which pays off your old mortgage and replaces it with a new one). Entering into a loan modification may put a dent in your credit score, so take that into consideration before signing anything.

Forbearance is an option that was widely extended to many Americans during the early part of the COVID-19 pandemic. In essence, forbearance allows you to stop making mortgage payments for a set period of time. The catch is that you may owe the entire amount you missed as soon as the forbearance period is over.

In a worst-case scenario, in which you think you may never have a chance of making your mortgage payments again, you may consider a “deed-in-lieu of foreclosure.” If you’ve ever heard the expression “give back the keys to the bank,” deed-in-lieu is the formal term for that process. You’re handing the asset — your home — back to the lender in exchange for being able to walk away from what you still owe on your mortgage.

A deed-in-lieu is obviously a serious, big step that should not be entered into lightly. It means leaving behind your home, as well as all the money you’ve paid for it so far. You should consult with a housing counselor and also a lawyer, if at all possible, before taking this step. If you cannot afford a lawyer, the Consumer Finance Protection Bureau has some low-cost options here.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”