Unlock Insights

Your one stop shop for the news of the day, personal finance, and home ownership tips.

Filter by topic

Medicare Basics: The What, When and How You Need to Know

If you or a family member have a 65th birthday on the horizon, there may be thoughts of working less (or not at all), taking bucket-list trips, pursuing a favorite hobby…and Medicare. Medicare is the federal health insurance program in place for people 65 or older, as well as some younger people with disabilities, and […]

Ways to Save on Your Thanksgiving Meal

Thanksgiving might kick off the holiday season, but it can also be the start of a season of overspending. Yet hosting the holiday meal doesn’t have to be hard on the wallet. Here are eight ideas to help you host a delicious, enjoyable dinner that celebrates family and friends with some smart spending. With careful […]

Do You Have an FSA? Here’s What You Need to Know About Using Your Funds

Key takeaways: Thinking about the end of year may not be on the top of your mind. But if you have a Flexible Spending Account (FSA) to help pay for healthcare costs, now is the time to think about using your funds. How FSAs work If you have a healthcare plan through an employer, you […]

How to Protect Your Identity Online

Key takeaways Staying safe online has never been harder — or more critical. Just when we get used to doing things one way, it seems, a new threat pops up. The good news is that there are a few solid steps you can take easily and inexpensively that will minimize nearly all the threats out […]

It’s Open-Enrollment Season: How to Make the Best Choices for Your Health Insurance Coverage

Open enrollment – the period when many Americans sign up for healthcare coverage or change an existing healthcare plan – begins soon. As inflation persists, and new surges of COVID-19 highlight the need for adequate and health insurance, many consumers are seeking more affordable insurance options, or coverage with more or different benefits. The open-enrollment […]

What You Can Learn From Your Grandparents About Finances

Key takeaways Grandparents may be known for spoiling their grandchildren, but they can also offer valuable life lessons – particularly when it comes to finances. Some grandparents have lived a fiscally conservative life, saving for a rainy day and paying for purchases with cash, not credit. Many lived through recessions, periods of unemployment and excessive […]

Simple Steps to Creating the All-Important Emergency Fund

Key takeaways: You know that having an emergency fund in place is important. You understand that some unplanned expense always comes up. And you know that depending on a credit card (or worse, a payday loan) when these unexpected expenses arise is not a good idea. But with the cost of living, inflation and a […]

What to do When Your Insurance Company Drops you

Key Takeaways: What’s happening in Hawaii is not only sad and tragic, it’s creating a long road to recovery which will cost billions of dollars. And it’s been occurring more and more frequently in locations across the planet. Families have been displaced, businesses have been leveled, not to mention the horrific harm to wildlife the […]

Send Your Student Back to School Without Breaking the Bank

Key takeaways: As most parents know all too well, shopping for back-to-school clothes and supplies is an expensive proposition. According to the National Retail Federation’s annual survey, consumers are expected to hit a new record on back-to-school spending this year: Families with children in elementary through high school plan to spend an average of $890.07. […]

How Do I Determine How Much I’ll Need to Retire?

Key takeaways: If you’ve been thinking nervously about the prospect of saving for retirement, you’re not alone. What’s more, the options you have for calculating, investing and spending may seem overwhelming. But before you start throwing numbers into an online calculator or buying financial products or services aimed at retirees, take some time to consider […]

Building a Budget for Your Summer Vacation

Key takeaways: Summer vacation is a time-honored tradition for most Americans. Sunny days, long evenings, barbecues, and often, a trip. But before you get packing, stop, think and do some planning. A little budgeting can go a long way in ensuring a fun trip that won’t leave you financially strapped and stressed. Start by referring […]

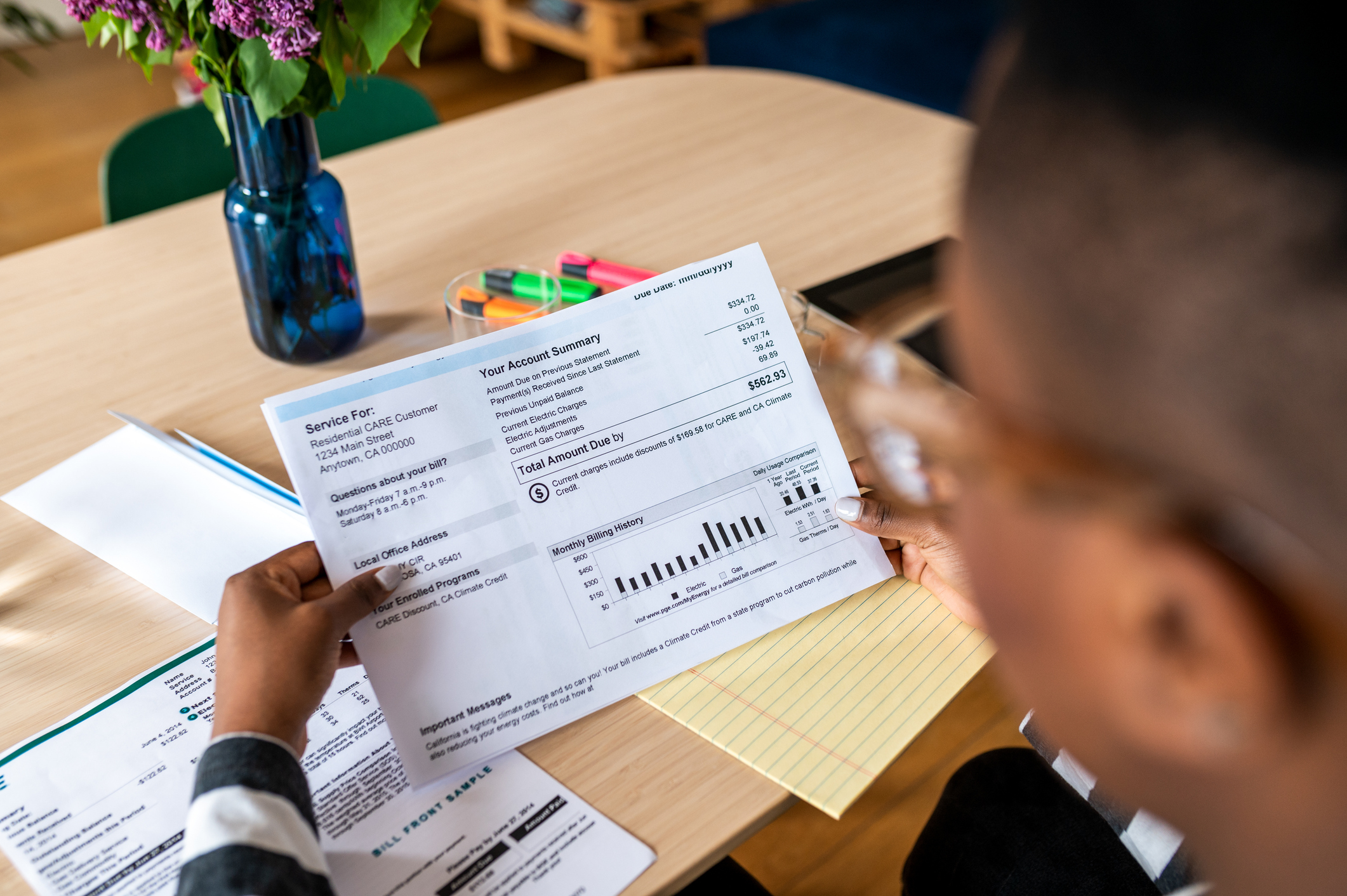

How to Save on Major Housing Expenses

Let’s face it, owning a home can be a great way to build long-term equity, but it can also be expensive. Between the mortgage, utilities, taxes, repairs, maintenance, insurance and in some cases, lawn care and homeowners association fees, the costs can really add up. Here’s a look at how to save money on three […]