Personal finances rank as greatest source of stress for 49% of homeowners

Key takeaways:

- Collectively, homeowners tend to feel the Fed’s recent rate drop is too little, too late. It is not motivating them to take significant action, whether that be to move, refinance, or pay off or take on more debt.

- Overall, homeowners aren’t more optimistic about the 2026 housing market compared to 2025, and many even think it will be a worse year to sell a home. Because of that, they’re largely planning to stay put in their current homes, and aren’t motivated to move or refinance until we see interest rates that may be a ways off.

- The bottom line is that homeowners are feeling the financial pinch, but even with rising economic uncertainty and stress, they still feel optimistic about the financial security of owning – and building equity in – a home.

U.S. homeowners continue to feel pessimistic about the economy, according to a new survey* from Unlock Technologies. Most anticipate spending even more next year on household expenses, while almost half report personal finances as the most significant cause of stress in their lives and more than a third are struggling to maintain funds to cover unexpected expenses.

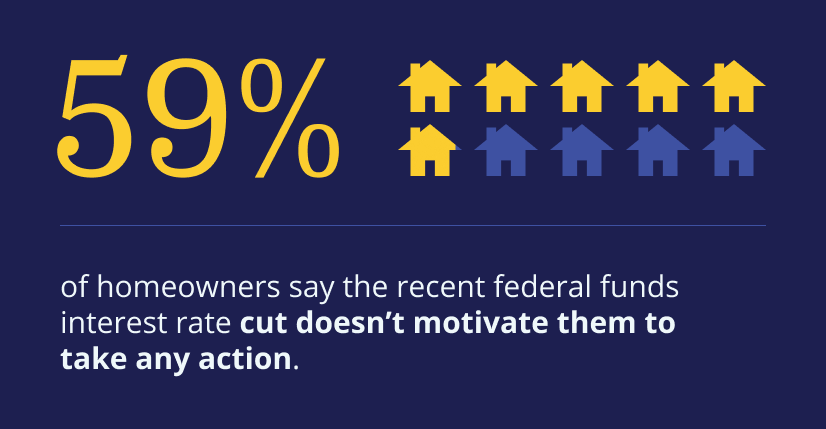

The survey, which took place after the recent Federal Reserve (Fed) action, indicates that the Fed rate cut – and forecasts for future cuts – have not bolstered consumers’ economic sentiment. “Consumers are feeling that the interest rate cut and any trickledown effect are not enough to make a substantial difference in their outlook on the overall economy, the housing market or on their personal finances,” says Michael Micheletti, chief communications officer at Unlock. “Heading into the last quarter of the year, we see homeowners facing continued high prices, financial concerns and rates that aren’t motivating them to take action.”

However, even with the less-than-rosy outlook, homeowners still overwhelmingly share the belief – regardless of how long they’ve owned their property – that home ownership remains one of the best ways to grow their personal wealth.

Uncertainty, pessimism prevail

More than half (54%) of homeowners say they are feeling uncertain or pessimistic about the U.S. economy right now, and 40% say they feel worse off financially than they did a year ago.

Household expenses persist as key problems for homeowners, with 55% anticipating spending more in 2026 than in 2025 to cover them. This is a full seven percentage points higher than when homeowners were asked the same question in January of this year. While everyone is impacted by climbing prices, lower-income Americans are feeling the brunt. Compared to how they felt a year ago:

- 47% of homeowners with an annual household income of less than $75,000 say they feel worse off financially

- 35% of homeowners with an annual household income of $75,000-$149,999 say they feel worse off financially

- 27% of homeowners with an annual household income of $150,000 or more say they feel worse off financially

Financial fragility among homeowners

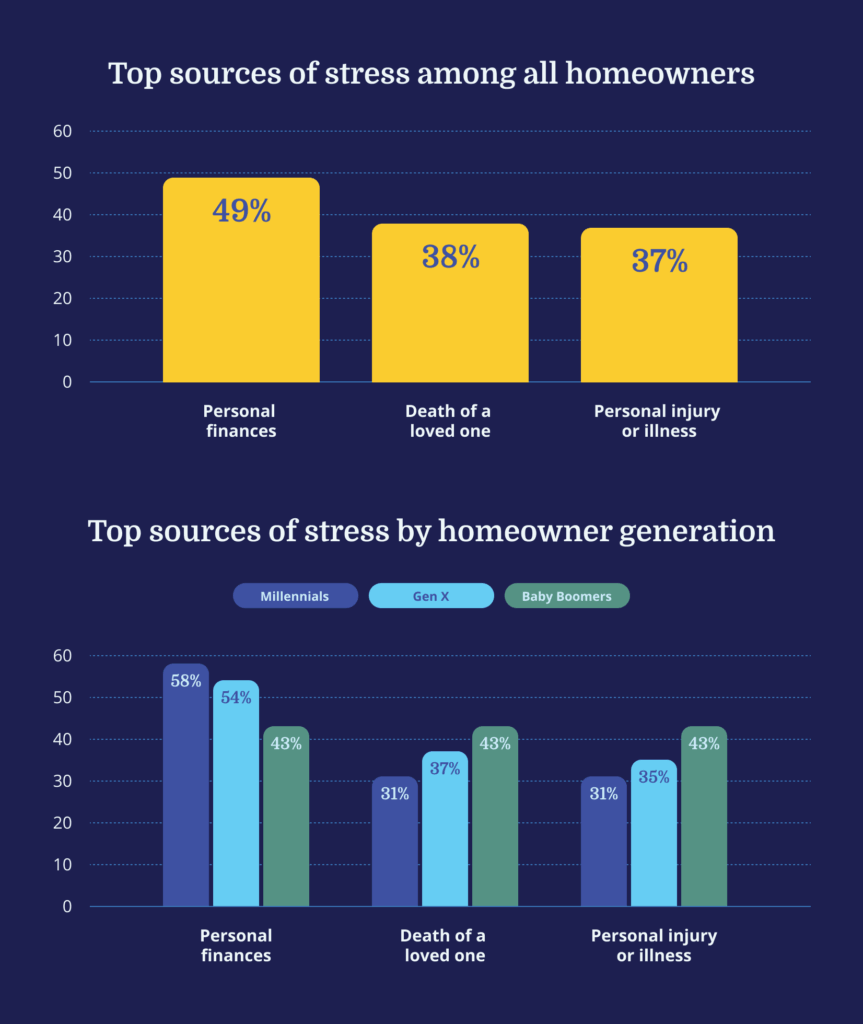

For almost half (49%) of homeowners, personal finances cause the most stress in their lives – and that number is even higher for Millennials (58%). Notably, this is followed by the death of a loved one (38%) and personal injury or illness (37%) across all age groups.

“It’s not surprising to see Millennials feeling the most stress from personal finances. They’ve also had a tougher time entering the housing market than preceding generations and been saddled with more debt because of rising education costs and the impact of the Great Recession,” says Micheletti. “What’s interesting, though also not surprising, is how the margins between stressors narrow for Gen Xers and Baby Boomers, who are a part of the ‘sandwich generation’ and can feel the pressure of helping children financially while also caring for aging parents.”

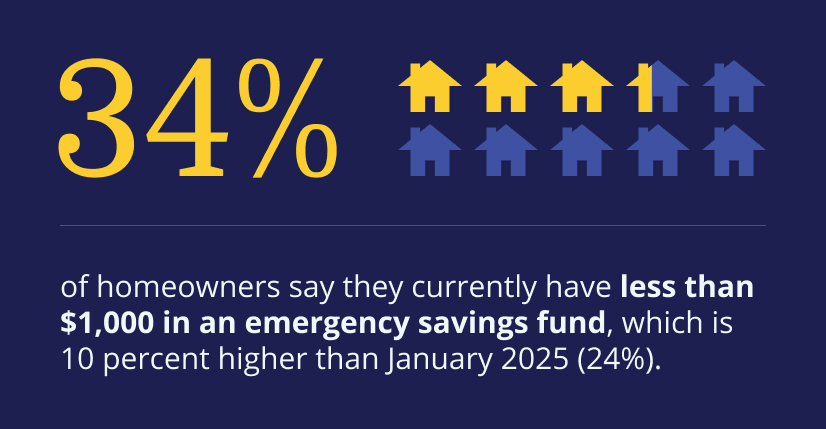

Regardless of age, inability to handle unexpected expenses may be contributing to that overall stress. More than a third of homeowners have less than $1,000 in an emergency savings fund. This is a marked increase since January, when just 24% said they had less than $1,000 in their emergency fund. Plus, 27% of homeowners have less than $500 – or none at all – saved for emergencies.

“Maintaining an emergency fund is important for every consumer, but especially so for homeowners,” continues Micheletti. “They must be ready to handle the inevitable unexpected expenses that come up, such as repairs and maintenance, higher-than-planned utility bills, and jumps in insurance premiums or property taxes.”

Homeowners want lower mortgage rates before buying, refinancing

Homeowners are, in large part, staying put. Despite the Fed’s recent announcement to lower the federal funds interest rate by 0.25%, and forecasts that this is the first cut of several, 59% of homeowners say it doesn’t motivate them to take any action at all, whether that’s buying and selling a home, refinancing or taking on additional debt.

Only a quarter believe 2026 will be a good year to buy a house, which is near even with responses from the January survey, suggesting most don’t think the market has improved year to date. And 59% say they are not likely to purchase a new home until a 30-year fixed-rate mortgage is 6% or lower, while a staggering 92% said they wouldn’t consider a cash-out refinance until rates dropped to 6% or below.

In addition, just a third of homeowners believe 2026 will be a good year to sell a home. That is seven percentage points lower than what we found in our January survey, in which 40% of homeowners thought that 2025 would be a good year to sell a home. This indicates that most people plan to keep waiting on the sidelines of the housing market, despite recent upticks in new mortgage applications.

Home ownership, home equity provide silver lining

In addition to the four in five (77%) homeowners who still believe that owning a home is still one of the best ways to grow personal wealth, 60% say having the option to leverage home equity provides an extra level of financial security. Just over one in ten (11%) are planning on pulling equity out of their home in 2026, while nearly one quarter (24%) of Millennials will look to tap into their home’s value in the year ahead. Generally, homeowners plan to use the funds for:

- Home improvements (50%)

- Debt payoff (44%)

- Build savings (38%)

Conclusion

While every consumer feels the impact of an uncertain economy and higher prices, homeowners face unique and sometimes-added burdens. Dealing with greater stress and increasing costs, they are closing out 2025 and heading into 2026 looking to stay put, with few plans to buy or sell in the near future.

*Methodology: Unlock commissioned Atomik Research to conduct an online survey of 2,010 homeowners throughout the United States Sept. 18-22, 2025. The margin of error is +/- 2 percentage points with a confidence level of 95%. Atomik Research, part of 4mediagroup, is a creative market research agency.

To download the raw survey data, click here.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”