Key takeaways

- Deciding when to take out home equity depends on your financial goals and current market conditions.

- Some methods for tapping home equity let you access it immediately, while others require you to wait six to 12 months.

- Cash-out refinance loans are best for those that need a lump sum and don’t mind taking on higher mortgage payments.

- A HELOC acts as a credit card that uses equity as a source of funds.

- Home equity agreements are an option as well – especially for homeowners wanting to avoid monthly payments.

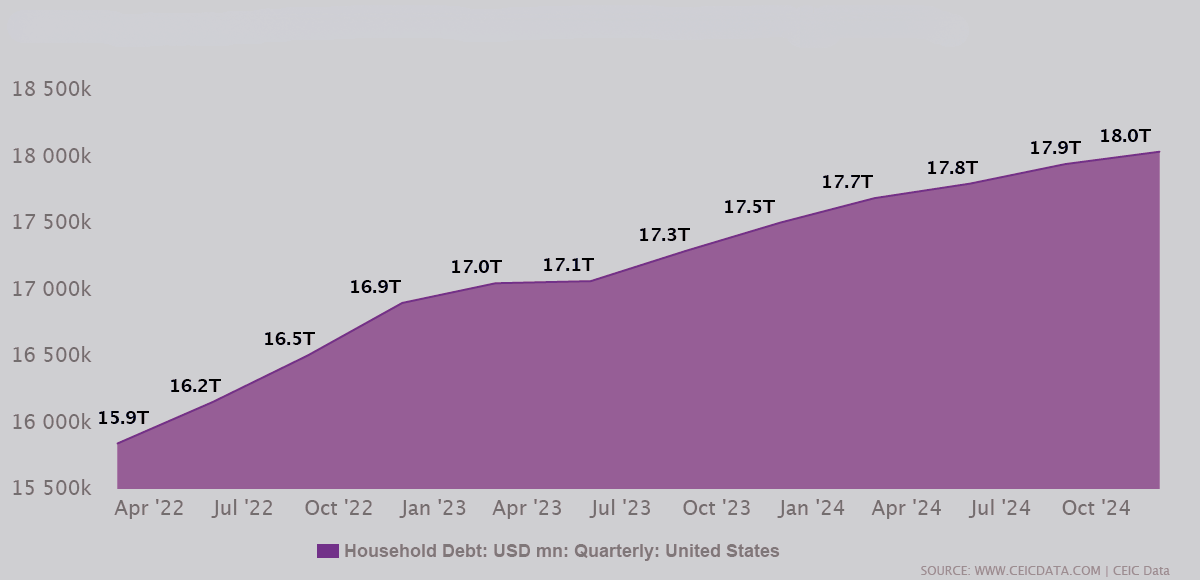

There is a reality that is ever-present for most homeowners: they are saddled with debt – particularly credit card debt. Americans’ total credit card balance was $1.2. trillion in the first quarter of 2025, according to the latest consumer debt data from the Federal Reserve Bank of New York. Combine this credit card debt with student loans, medical debt, auto loans and other forms of debt, and you can understand why the collective debt of the American household has soared past 18 trillion. The chart below (based on information from the database CEIC Data) shows how fast our debt has grown in recent years.

The good news is that there are solutions. You can tap into your home equity to access liquidity that can aid you in your mission to eliminate debt.

What is home equity?

Let’s start with the basics. Home equity is the difference between the current market value of your home minus anything you owe on the property, including liens and loans (such as your mortgage). Initially, home equity is obtained as soon as you put a down payment on the property. From there, your home equity rises as you pay off your mortgage and your property value appreciates.

How soon can you pull equity out of your home?

Although you start building equity as soon as you put money toward the house, you typically can’t access it immediately. How long you need to wait depends on a number of factors, including the type of borrowing you plan to do, the individual lender’s criteria, and how much equity you’ve built so far. You’ll generally need to wait six months to a year before you can access the equity through refinancing, a period called “seasoning.”

You may be able to access your equity faster through other methods. However, these usually require at least 20% equity in the home before you’re eligible. That can be tough for new homeowners unless they put down 20% at purchase.

Top times to take equity out of your home.

The best time to take equity out of your home depends on your financial goals, but there are some common times people access their home equity:

- When interest rates are low: One of the most popular times to access your home equity is when interest rates drop. Falling interest rates make it more affordable, and therefore more attractive, to borrow.

- When preparing for significant home improvements: One common use of home equity is financing big renovations, upgrades, and repairs to your home. If you have major projects planned, tapping home equity can help you pay for it.

- When consolidating high-interest debt: Accessing home equity is far less expensive than high-interest debt, including credit card debt. That’s why it makes sense to use your equity to pay off that debt using your equity, allowing you to escape the interest charges that compound every month.

- When facing large or unexpected expenses: Another common time for many people to take equity out of their home is when they are facing large expenses, such as college tuition or medical expenses. Tapping your home equity provides a source of funds you can use to handle these costs without disrupting the rest of your budget.

How to tap into home equity

There are several methods to tap into your home equity. These methods vary by waiting period, interest rate, and monthly payment. Let’s explore the differences between the different home equity options and who they’re best for.

| Method | Waiting Period | Interest Rate | Monthly Payments | Best Use Cases | |

| Home equity agreement | Immediately (but requires at least 35% to 40% equity) | None | None | Avoiding monthly payments or added debt. Can be used however a homeowner likes. | |

| Home equity loan | 6-12 months | Fixed | Yes | Large expenses, debt consolidation | |

| HELOC | 6-12 months | Variable | Yes | Ongoing expenses, flexibility | |

| Cash-out refinance | 6-12 months | Varies | Yes | Lower interest rates, refinance | |

| Reverse mortgage | 6-12 months | Varies | No | Retirees needing income |

Home equity agreement

A home equity agreement (HEA) allows you to receive cash now in exchange for the HEA provider receiving a share of your home’s future value. HEAs are not a loan, so there are no monthly payments or interest. You don’t have to sell your home or borrow against your equity when using a home equity agreement.

Who qualifies for a home equity agreement? HEAs are relatively flexible compared to some other home equity options. In general, homeowners must have a maximum loan-to-value (LTV) of 75%. That means the home’s mortgage must be 75% or less of the appraised value of the home. Homeowners will also need at least 25% equity in their home and a credit score of 600 (although some providers, like Unlock, work with those who have scores in the 500s). There are no age restrictions to use a home equity agreement.

Who is a home equity agreement best for: Home equity agreements are best for people who are looking for ways to take equity out of their home without monthly payments or interest.

Cash-out refinance

A cash-out refinance (cash-out refi) replaces your current mortgage with a new, larger loan in an amount more than what you currently own on your house. You receive the difference in cash, and can use that money for whatever needs you have. Because you are taking on a larger mortgage, you may have larger monthly payments for the duration of the loan, which is often 15 or 30 years. Additionally, you should consider any prepayment or cancellation penalties, and closing costs that average two to five percent. You may need to wait six to 12 months to be eligible for a cash-out refinance after purchasing your home.

Who qualifies for a cash-out refi? A refi is a new loan, so you’ll need to meet the lender’s eligibility requirements in terms of credit score, debt-to-income ratio (DTI), LTV, and other criteria. You should also consider the interest rate you’ll receive and how that will affect your payments.

Who is a cash-out refi best for? This method of tapping home equity is best for those looking for lower interest rates and a long repayment period.

HELOC

Another alternative is a home equity line of credit (HELOC), which uses your home’s equity as a source of funds and allows you to borrow funds as needed up to a certain limit. HELOCs are loans with adjustable rates, which means the interest rate on your HELOC will fluctuate based on the market.

HELOCs come with minimum draw requirements and annual fees, and often have substantial prepayment penalties. If the value of your home decreases, then lenders can reduce your credit line or revoke it completely.

Who qualifies for a HELOC? You must meet the lender’s requirements. Typical requirements include:

- A credit score that is no lower than 620. Ideally, a score of 700 or higher is best.

- A maximum DTI of 43% or lower.

- A maximum LTV of 85%.

- Equity in your home of at least 15-20%.

Who is a HELOC best for? HELOCs are best suited to those who want a flexible way to access their home equity when they need it.

Home equity loans

Home equity loans differ from HELOCs in that they are not lines of credit. Instead, they allow homeowners to receive a lump sum of cash up front, then pay it off with monthly payments and interest.

Who qualifies for a home equity loan?

Once again, you must meet the lender’s loan requirements. Typical requirements include:

- A credit score that is at least 620 or higher.

- A maximum DTI of 43% or lower.

- A maximum LTV of 85%.

- Equity in your home of at least 15-20%.

Who are home equity loans best for? These loans are best for those who prioritize fixed interest and regular monthly payments and have good to excellent credit.

Reverse mortgage

A reverse mortgage converts home equity into cash, allowing homeowners 62 and older to supplement their retirement income. Instead of paying the lender, the lender pays you, and the balance increases, not decreases, over time. With a reverse mortgage, you are still responsible for paying taxes and insurance on the property and must use the property as your primary residence. If you want to leave the property to family, you should know that those who inherit it will take on the reverse mortgage debt if it has not been paid off before your death.

If you fail to keep up with property tax and insurance, you risk foreclosure. The loan is due at the end of the agreed-upon period, or when the homeowner moves out or passes away.

Who qualifies for a reverse mortgage?

To meet the lender’s loan requirements, you must:

- Be 62 years of age or older.

- You must own your home outright, or have a single primary lien on your home.

- A maximum LTV of 50-65%.

Who is a reverse mortgage best for? This loan type is best for those seeking to supplement retirement income and who aren’t planing to leave their home as an inheritance.

Unlock your equity potential with Unlock’s home equity agreement (HEA)

Accessing your home equity can open the door to new possibilities, such as home improvements or higher education. Unlock’s HEA allows you to tap the wealth you have built in your home without adding more debt. There’s no need to refinance, add monthly payments to your obligations or worry about fluctuating interest rates. Discover how Unlock Technologies can make home equity accessible for you.

Q. What factors determine how soon I can access home equity?

A. There are several factors that determine when you can take equity out of your home: how much equity you have, how recently you purchased the home, and the type of home equity method you choose. Provided you have sufficient equity in the home, the fastest ways to access it are through a home equity agreement or reverse mortgage.

Q. How does my credit score affect my ability to tap into home equity?

A. If you’re tapping your equity through a cash-out refinance, home equity loan, or HELOC, your credit score will play an important role. Those loan types require good credit to qualify. A home equity agreement (HEA) is an option available to those who may not have perfect credit.

Q. How can I get equity out of my home without refinancing?

A. Not everyone wants a bigger mortgage. If you want to take equity out of your home but don’t want to apply for a new home loan, you could use a home equity agreement, which is not a loan. Other methods of tapping home equity involve borrowing, including home equity loans, HELOCs, and reverse mortgages.

Q. What’s the best time to tap my home equity?

A. It depends on your circumstances, but many people tap their home equity to pay for home renovations or to consolidate debt. The best time to tap your equity is when your home has appreciated, you’ve built up substantial equity, and you’ve determined a specific purpose for the funds.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”