Key takeaways:

- Selling your home to a real estate company can save a lot of hassle, but you may give up more money than you realize.

- With such a big transaction, it’s worth taking extra time to make sure you understand all the options, and to see if there are any you haven’t considered.

You’ve probably heard the sales pitch: We’ll buy your home, no questions asked. For a homeowner who wants to sell but doesn’t want to make repairs, do a deep clean, stage the furniture for a photographer, and have hordes of buyers roaming around during open houses, it may seem too good to be true.

The reality is that selling your home to a real estate company – sometimes called an iBuyer – is a very mixed bag. In this article, we’ll explain more about what you can expect from the process, as well as the pros and cons.

First off, what the heck is an iBuyer? For as long as there’s been real estate, there have been companies that will buy homes in as-is condition, with no need for the owner to do anything to make it ready for the market. You may have seen billboards or flyers for companies that use the motto, “We Buy Ugly Houses,” for example.

“iBuyer” is a term that emerged in the 2010s to describe companies with a similar business model but a slightly more digital polish. You may have heard of Opendoor and Offerpad, for example, and at one time the massive real estate listings service Zillow even had an iBuying service.

Companies that buy a home “as is” from a homeowner can be viewed as offering a needed service. Many homeowners do not have the time, energy, or ability to make the upgrades that many properties need to be listed on the real estate market. Some upgrades – think of a new roof or electrical repairs – can run into the thousands, and many homeowners don’t have that kind of money just lying around, or the time to research and engage a contractor.

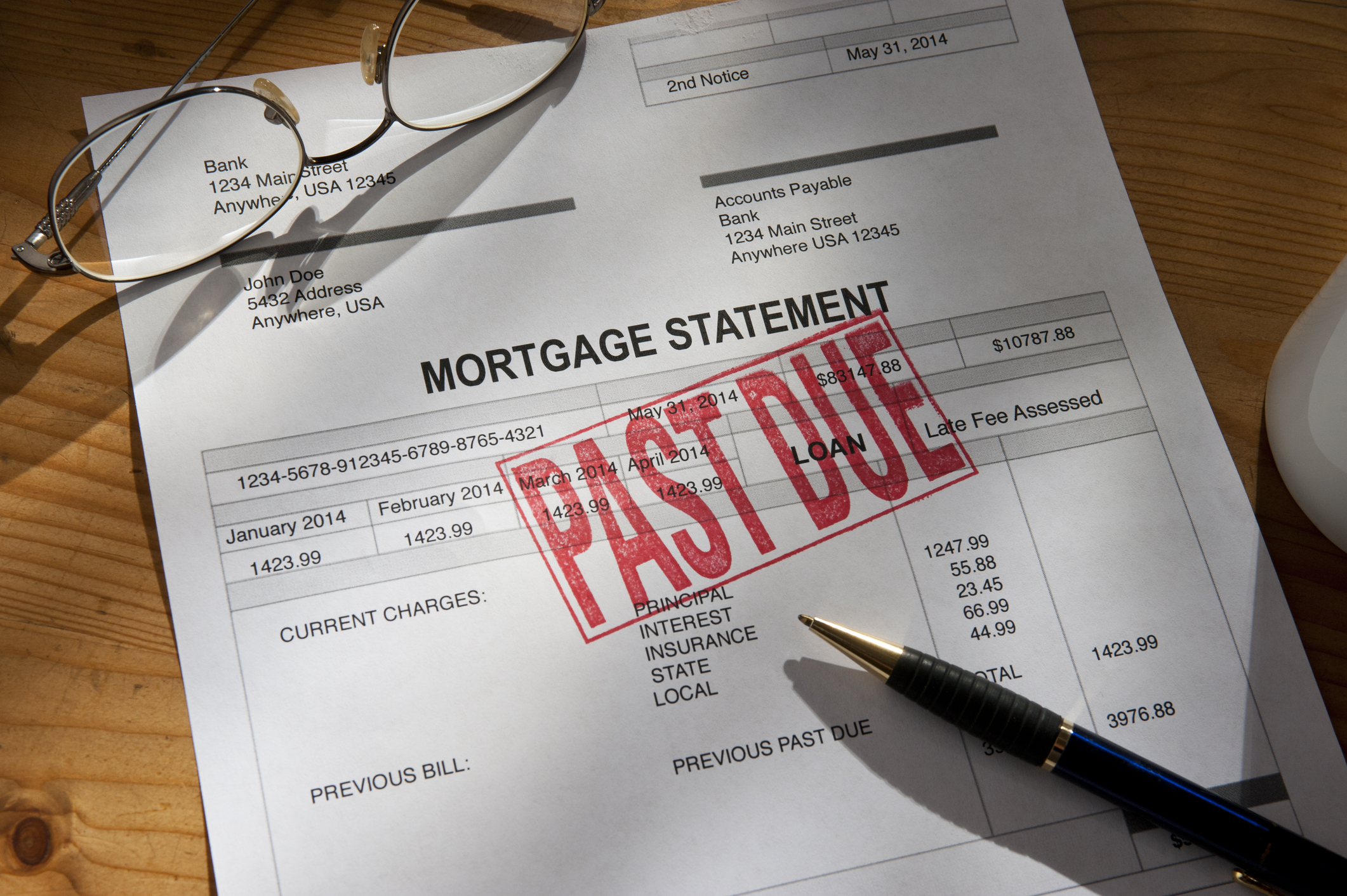

But what may not be so clear is just how much you’ll give up by skipping those steps. And you should know that over the past few years, journalists and real estate analysts alike have repeatedly shown that iBuyers pay homeowners far, far less than they’d fetch on the open market. Keep in mind that since iBuyers or investors are expecting to turn a profit when they re-sell your home, they typically offer you a discounted price to make the math work. In 2021, one real estate analyst found that the difference between the iBuyer’s offer and the sale price was as much as 12%

The other thing to consider when selling to an iBuyer is how much time you need to close and find a new home. Policies vary by company, but you may not have the same flexibility to stay in your home after closing as you would if you sold to an individual buyer. And, while you’ll save money on real estate commission fees, you’ll be on the hook for repair costs and service fees when you sell to an investor.

It’s also worth noting that if you are already in a home equity agreement (HEA), your provider may determine your payout amount based on the appraised value of your home rather than the sales price. This is more likely if your provider believes the sales price is significantly lower than the market value of the property. It’s important to review your contract carefully and understand everything that goes into calculating what you’ll owe your provider. It may be different from what you think.

“The convenience of selling to an iBuyer or investor may seem like an attractive option, but it comes with a hidden cost: loss of equity,” said Brandan Carlson, Head of Customer Success for Unlock Technologies. “If you accept a below market rate offer on your home, anyone holding a lien on your property will still expect to be paid in full, meaning you’ll be cutting into your own proceeds.”

As with so many things in real estate, selling a home is a very personal step. If you are aware of the iBuyer model and discounted price, and decide to take advantage of the opportunity anyway, that’s up to you. Still, it may be worth considering other approaches.

Talk to as many people as you can. Get quotes from companies, but also interview real estate agents. Explain your concerns about putting money and time into your home and see what the response is.

Can you find a real estate agent who can identify just one or two upgrades that would give you the biggest bang for the buck? If you dread having would-be buyers coming into your home, can you ask the agent to limit the number of days they’re allowed in – or allow only open houses, no private showings?

Whenever you decide to sell and however you decide to do it, we wish you the best kind of luck! Your home is special to you, but it’s also an investment. You deserve the most money you can get, and the most seamless process possible.

The blog articles published by Unlock Technologies are available for informational purposes only and not considered legal or financial advice on any subject matter. The blogs should not be used as a substitute for legal or financial advice from a licensed attorney or financial professional. Links in our blog posts to third-party websites are provided as a convenience and are for informational purposes only; they do not constitute an endorsement of any products, services or opinions of the corporation, organization or individual. Unlock Technologies bears no responsibility for the accuracy, legality, or content of external sites or that of subsequent links.