Let’s face it, owning a home can be a great way to build long-term equity, but it can also be expensive. Between the mortgage, utilities, taxes, repairs, maintenance, insurance and in some cases, lawn care and homeowners association fees, the costs can really add up.

Here’s a look at how to save money on three of the priciest housing expenses outside your mortgage: insurance, property taxes and utilities.

Insurance: Homeowners insurance is not something you should skimp out on, but it could pay to shop around. If it’s been a while since you’ve compared rates, it could be worth doing some research. Your state’s division of insurance should be able to provide information on average premiums in your area to give you an idea of where to start. Experts typically recommend getting at least three quotes to compare. Some other money-saving strategies include:s insurance with your auto insurance

- Bundling your homeowners insurance with your auto insurance

- Increasing your deductible. Increasing your deductible will lower your monthly premiums, just be sure you have enough money saved to cover a major claim if one should arise.

- Looking for discounts. For example, making your home more secure or disaster-resistant by installing a security system, fire alarms or fire sprinklers, could qualify you for a discount. Having a newer roof or living in a gated community could also reduce your premium.

Property Taxes: There’s no escaping property taxes even after you’ve paid off your mortgage. While property taxes vary widely by area, taxes are rising in general nationally. The average tax on single-family homes nationwide jumped 3% in 2022, averaging $3,901 annually, according to study from ATTOM Data Solutions. Thankfully, there are a few ways to potentially cut your tax bill:

- Report and correct erroneous property information. Carefully review your annual assessment. If you spot any discrepancies, flag them immediately, and find out from your assessor how you can correct them. If officials have incorrect information on your lot size, number of room or other features it can cost you money.

- Research similar homes in your area. Review the assessments of comparable homes in your neighborhood, as well as general stats about local evaluation values. If you find a discrepancy, it could help reduce your property taxes. For example, For example, let’s say that your three-bedroom house with a one-car garage has an assessed value of $350,000. If a nearby three-bedroom home with a two-car garage and a finished basement is valued at $300,000, the assessor may have made an error.

- See if you qualify for an exemption. In some jurisdictions, you may be eligible for state or municipal property tax exemptions if you are a senior, veteran or have a disability. Some agricultural properties may also be eligible for property tax exemptions.

- Appeal your bill. To win the appeal, you must prove that your home’s assessed value is higher than it should be. One way to do this is to show that comparable properties in the vicinity have sold for less. You may also need to provide pictures and other information on the current condition of your home. if the reviewer approves your appeal, they’ll only lower your home’s assessed value – not the tax rate itself. Your local authorities will continue to tax you at the established rate. However, you’ll still benefit from an overall reduction in your property tax bill.

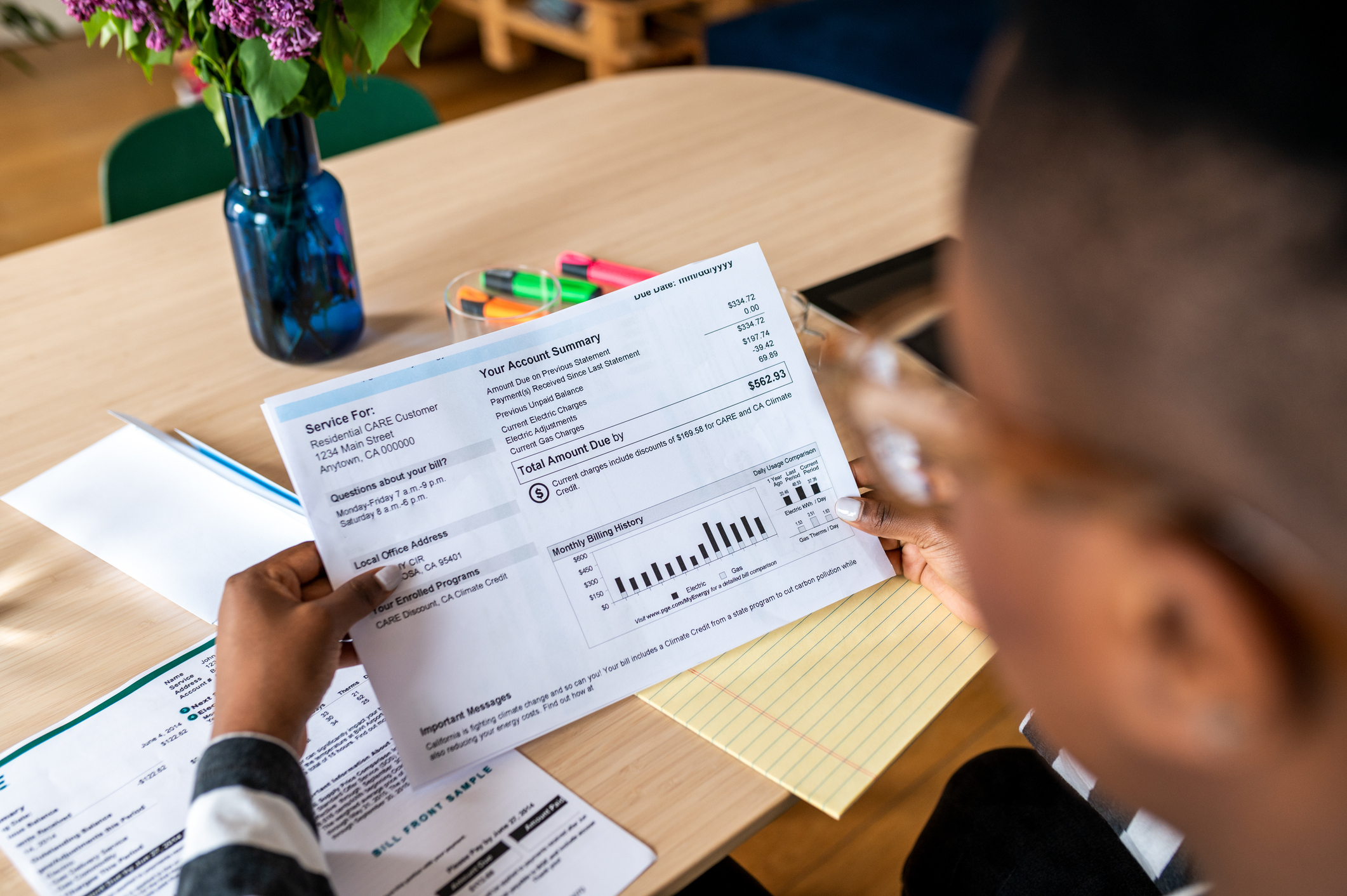

Utilities: The cost to heat, cool and power your home continues to climb. High costs have had an impact, with nearly 20 million households behind on their utility payments as of March 2023, according to the National Energy Assistance Directors Association. If you are struggling with paying your utility bill, check to see if your state offers an energy assistance program. Some local utilities also help, so it might be worth looking at their website for more information. In the meantime, here are some other options to help cut your utility costs:

- Invest in a smart thermostat. A programmable thermostat provides the ability to set different temperatures for when you’re sleeping or away from home. The U.S. Department of Energy estimates that lowering the temperature by 7 to 10 degrees during those times can save 10% annually in heating costs.

- Seal windows and doors. There are a variety of relatively inexpensive options for sealing doors and windows, from foam tape to caulk to a variety of weather-stripping materials. Gaps in frames allow air to leak through your home’s envelope, making it challenging to regulate internal temperature.

- Switch to LED bulbs. In recent years, LED lights have replaced incandescent bulbs for home illumination. LED bulbs are extremely energy efficient. They last about 25 times longer, generate less heat and provide better light quality than incandescent bulbs.

- Buy a tankless water heater. If it’s time to replace your water heater, you might consider a tankless version. While more expensive than a traditional option, a tankless water heater lasts longer and is more efficient.

- Add attic insulation. Without insulation, the transfer of hot air causes temperature fluctuations throughout the home, making it difficult to regulate a comfortable setting. This overworks your heating and cooling equipment and results in high utility expenses.

Implementing even a few of these ideas could help put more money back into your pocket, hopefully making home ownership a little more affordable.