Key Takeaways

- U.S. homeowners are feeling less optimistic about the economy and their finances

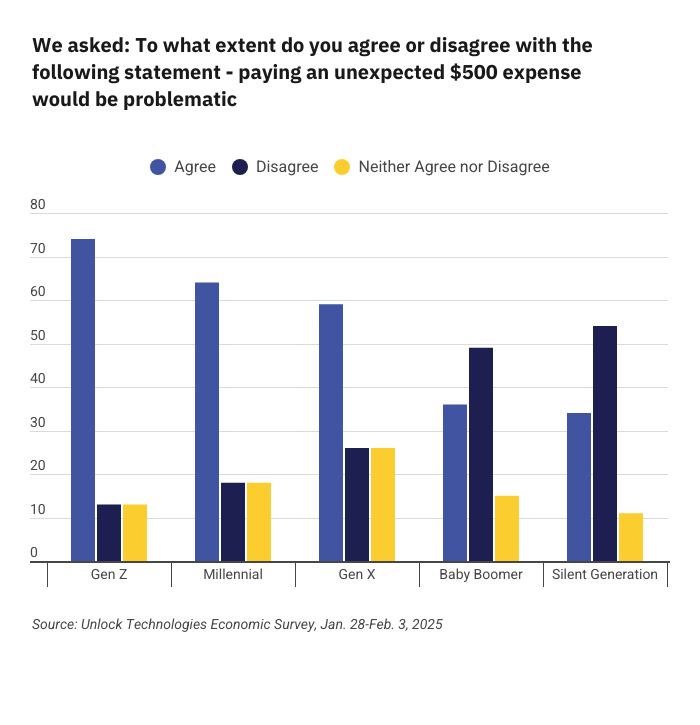

- Fifty-one percent are not prepared to handle an unexpected $500 bill

- The majority expect home prices and mortgage rates to remain high

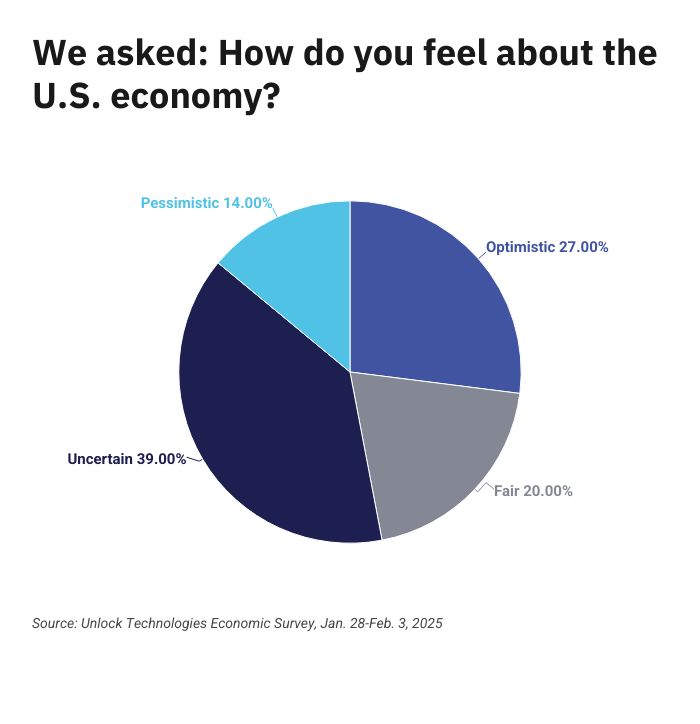

The year is young, but U.S. homeowners are already expressing less confidence in the economy. In Unlock’s first survey examining homeowner sentiment about their finances, savings, debt levels and the economy as a whole, we found that 53% of homeowners are feeling uncertain or pessimistic about the economy. (See chart below).

The outlook for the future isn’t much brighter, with 50% expecting a recession in the next five years. Thirty-six percent of homeowners anticipate a recession in the next two years.

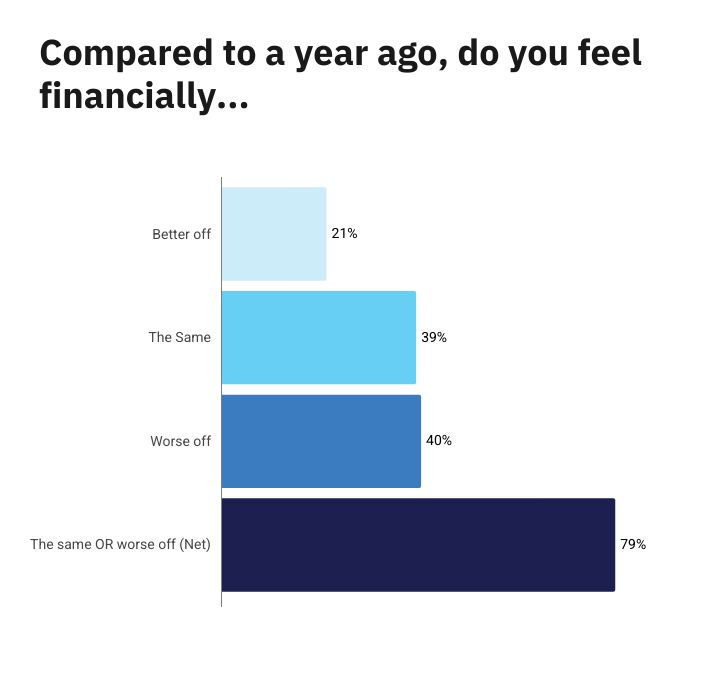

Homeowners appear to have similar pessimism when it comes to how they view their personal finances. When asked how they felt financially compared to a year ago, 40% said they were worse off, while 39% said they felt the same financially as the year before. Just 21% said they were better off.

“Some measure of uncertainty looms for U.S. homeowners in the year ahead,” says Unlock’s Chief Communications Officer Michael Micheletti. “The start of 2025 finds homeowners facing a difficult economic landscape, marked by rising expenses, increased debt burdens, and a general lack of optimism regarding the housing market.”

Savings down, expenses up

So, why are homeowners feeling more doubtful about their finances? Declining savings and rising expenses could be the culprit. Sixty-five percent of homeowners said they had less $5,000 in savings, while 24% said they had less than $1,000 in savings. Even more telling, 51% said that an unexpected $500 bill would be problematic. Gen Z homeowners appear to be the least prepared for an emergency expense, with 74% acknowledging that a $500 bill would be problematic, followed by 64% of millennials.

Inflation continues to take a toll

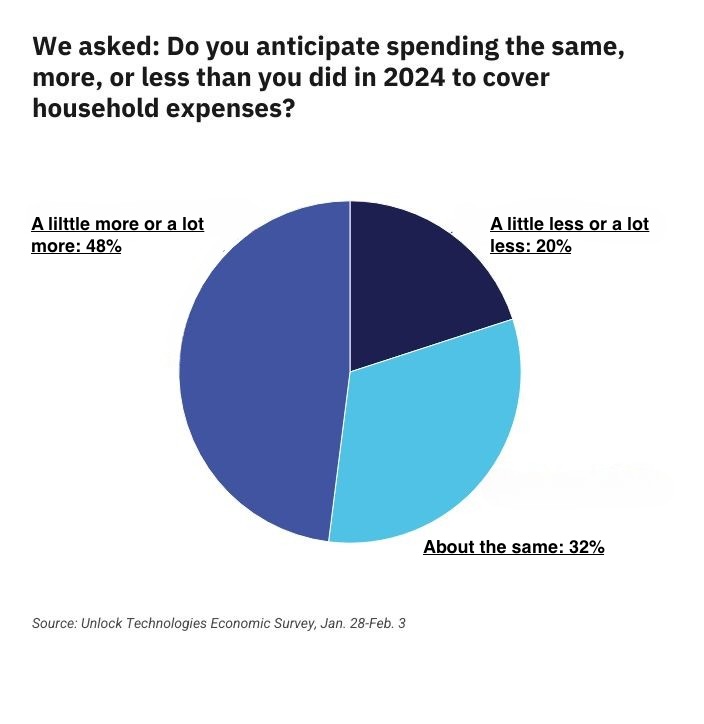

Rising prices could be making it more of a challenge for homeowners to save, as evidenced by the fact that even homeowners with higher incomes expected to spend more to cover housing expenses in 2025. Overall, nearly 48% of homeowners said they anticipated spending more on household expenses this year. Fifty-one percent of those with incomes between $100,000 and $199,999 expected household costs to eat up more of their budgets this year, while the same held true for 46% of homeowners with incomes of $200,000 or more. The results are perhaps not surprising, given the 3% rise in inflation in January and the Federal Reserve’s ongoing battle to fight continuing price pressure.

Debt on the rise

Homeowners could be relying more on debt to deal with the higher cost of living. Thirty percent of U.S. homeowners report they have more credit card debt than a year ago. And nearly 1 in 3 (32%) of U.S. homeowners with an annual household income between $100,000 and less than $200,000 report they have more credit card debt than a year ago. When asked what they might do if they received a financial windfall, 47% of homeowners said they would use the new funds to pay off debt and 24% said they would add to savings.

Pessimism extends to housing market

High prices and high mortgage rates made it difficult for both home buyers and sellers to make a move in 2024 and homeowners don’t seem to think things will change much this year.

- More than half of the homeowners (54%) in our survey expect home prices are going to increase in the next 12 months.

- Two-thirds (66%) believe mortgage rates will increase within the next 12 months.

As a result, it may not be surprising to discover that three out of four (76%) of homeowners surveyed do not believe 2025 will be a good year to buy a home. This is most pronounced among those with annual household incomes of less than $100,000, with 80% indicating they don’t believe that, or aren’t sure whether, 2025 is a good year to buy a home.

Selling a home might not be much easier. When asked if they believed 2025 would be a good year to buy a home, 60% of homeowners said no or that they were unsure about it. Forty-six percent cited finding a new place to live as the chief barrier to selling a home, followed by home prices at 46%.

Concerns about accessing home equity

Nearly 1 in 10 (9%) homeowners are planning on pulling equity out of their home in 2025. Among this group, 57% said they are considering using a home equity loan to access their home equity, while 48% are considering a home equity line of credit. Forty-two percent said they would consider accessing their equity if it were possible to do so without a loan or taking on another monthly payment.

Unlock’s home equity agreement (HEA) is a no-loan way of accessing home equity, providing homeowners with a lump sum of cash in exchange for a share in their home’s future value. Our HEA has no monthly payments, no interest fee and no income requirements to qualify.

Conclusion

Homeowners are starting the year with a cautious view of the economy. They are also feeling more pessimistic about their personal finances thanks to rising housing expenses, increasing credit card debt and concerns about having enough savings to handle emergency bills. This may translate into slower home sales as homeowners are hesitant to make a change given continued high mortgage rates and housing prices.

Homeowners who want to tap the home equity they’ve built in their homes without selling, may want to consider a home equity agreement (HEA). With an HEA, a homeowner can access their equity without replacing their mortgage.

Methodology: Commissioned by Unlock Technologies, the survey of 2,002 homeowners throughout the United States was conducted by Atomik Research Jan. 28-Feb. 3. The margin of error is +/- 2%, with a confidence interval of 95%. Atomik Research, a part of 4media group, Inc., is a creative market research agency.

Download the raw survey data here.