In August, real estate data provider Zillow made a splash by forecasting that home prices would gain 5.8% in 2023. That’s a big shift from earlier forecasts, and it makes the Zillow team much more bullish than other experts, many of whom are still calling for a decline in prices. Here’s what’s going on.

The argument for higher prices

As Zillow economists point out, it’s all about supply and demand. Americans still want to buy homes and there are still too few of them available for purchase. As a result, buyers continue to bid up the prices on the few homes that do come on the market.

Many experts had believed higher mortgage rates and the overall lack of supply in the housing market would depress home sales enough that prices would decline. Indeed, sales figures have fallen off a cliff. They’re at their lowest level since 2010, when the housing market was still reeling from the subprime bubble popping.

But Americans still want to buy, and for now, many of them have the means to do so despite higher mortgage rates. The National Association of Realtors, which tracks sales of previously-owned homes (not new construction), has noted an increase in the share of sales that are all-cash, to 26% in July.

And more Americans are taking out adjustable-rate mortgages, the Mortgage Bankers Association (MBA) says, hoping to get into a home, then refinance into lower longer-term loans later.

The argument for lower prices

But even though there are still people who are willing and able to bid on higher-priced homes, there’s still simply not enough inventory to go around. The supply of homes available to buy is just half of what it was before the pandemic hit.

Many experts still believe that the housing market will run out of steam this year, an argument for prices heading lower. As one example, the MBA notes that the number of people applying for mortgages — an early sign that they want to try to buy a home — is at the lowest level since 1995!

One of the biggest holdups in the housing market is mortgage rates, as we discussed earlier. And while it’s true that many people do find workarounds, such as buying with cash or using less-traditional mortgages, there aren’t as many buyers out there as there once were. For current homeowners who are considering selling, that’s a red flag, and many are simply choosing to stay put until market conditions are more receptive.

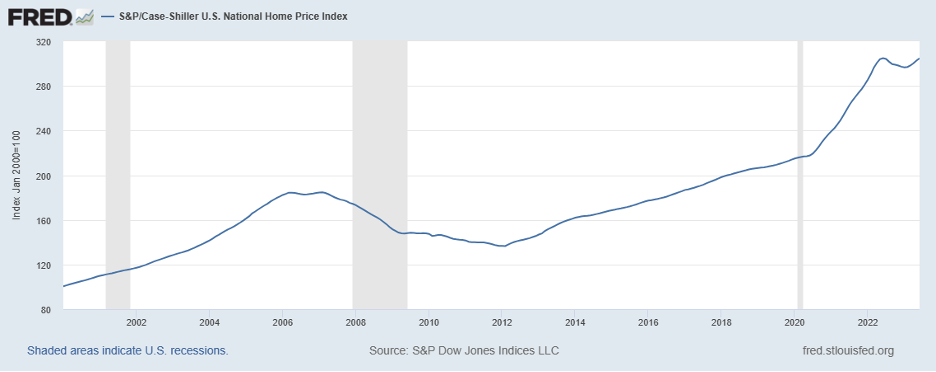

Sources: S&P Dow Jones Indices, St. Louis Fed

It’s important to note that overall home prices have softened slightly already, as shown in the chart above, in the second half of 2022 and first half of this year. Zillow’s comments refer to a full-year price forecast for 2023, and you can see how prices have picked back up after that earlier hiccup.

Up or down?

With all those factors at play, it’s no wonder it’s so hard to figure out the path of home prices from here. A recent survey of experts shows they’re divided. Here’s where they land, and how they explain their thinking.

Up. Zillow economists: “Zillow’s forecast of the nation’s typical home value was revised upward this month as tight inventory conditions continue to place upward pressure on home prices, despite persistent affordability challenges.”

Down. National Association of Realtors Chief Economist Lawrence Yun: “Compared to last year, national median existing-home prices will remain steady – declining 0.4%, to $384,900, before rebounding by 2.6% next year, to $395,000.”

Up. Freddie Mac economists: “Our corporate forecast for the next twelve months has house prices rising by 0.8%…We believe the rebound in prices is driven by a combination of very tight supply and the large cohort of Millennial first-time homebuyers reaching prime home-buying age. It is evident that despite affordability issues, there is tremendous demographic-driven demand for houses relative to supply, which will continue to keep upward pressure on prices.”

Down. Realtor.com Chief Economist Danielle Hale: “Home price growth continues to cool, but affordability has been a more substantial drain on demand, especially in the West. As a result, we’ve revised our home price forecast from growth to decline, with a modest 0.6% slip for 2023 as a whole.”

In short, it’s anyone’s guess whether home prices will rise, decline, or flatline during 2023. And since all real estate truly is local, there will probably be some of each outcome throughout the country. That adds up to a little bit of good and bad news for everyone: would-be buyers won’t catch a break, while current homeowners won’t see their equity gain all that much. On the other hand, few homeowners are likely to tumble into underwater status, and buyers still have a strong economy keeping them employed and earning.

The blog articles published by Unlock Technologies are available for informational purposes only and not considered legal or financial advice on any subject matter. The blogs should not be used as a substitute for legal or financial advice from a licensed attorney or financial professional. Links in our blog posts to third-party websites are provided as a convenience and are for informational purposes only; they do not constitute an endorsement of any products, services or opinions of the corporation, organization or individual. Unlock Technologies bears no responsibility for the accuracy, legality, or content of external sites or that of subsequent links.