Key takeaways:

- Home equity is at an all-time high, meaning many homeowners can tap into a significant amount of cash.

- Selling a home today is challenging and may not be the best way to recoup the equity you’ve built up in your home.

- There are a variety of options available to let you access your home equity.

Home prices have surged. Here’s how to tap into that equity if you aren’t ready to sell

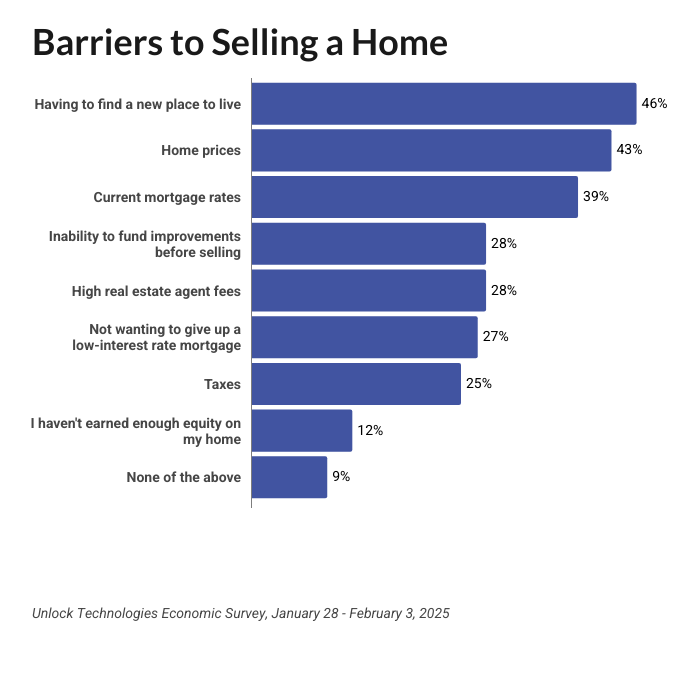

Selling your home these days is not high on the list of priorities for American homeowners. In a recent survey Unlock conducted, we learned that 60% of homeowners were unsure or didn’t think that 2025 would be a good year to sell a home. The reasons are varied. The chart below reveals what our respondents said would be barriers to selling their homes:

And, in many cases, people simply do not want to take on the stress and work involved in moving. Looking at this picture, it’s easy to see why sales of existing homes fell almost 5% from December 2024 to January 2025, according to the National Association of Realtors.

At the same time, home equity stands at an all-time high. Thanks to rapidly increasing housing prices over the past several years, homeowners have accumulated a collective high of more than $32 trillion in home equity, reported CNBC. Those who want to access that equity and turn it into a liquid asset – cash – have plenty of options to do so beyond selling. While several loan products are available, homeowners also have alternatives to consider.

Loan options to access home equity

- Home equity line of credit (HELOC): Along the lines of how a credit card works, a HELOC offers a line of credit from which you can draw. You can obtain funds up to the amount extended to you, as you need the money. While some fixed-rate HELOCs are available, most are variable-rate. That means that the interest rate can change during the term of the loan – as often as monthly. Whenever the rate changes, so will the monthly payment. Qualification for a HELOC is based on your credit score, your home’s loan-to-value (LTV) ratio and your debt-to-income (DTI) ratio. LTV is the amount of your existing loans (mortgage and any other loans you have on the property) divided by the value of your home. DTI is the percentage of your monthly income that goes to debt payments. Criteria will vary by lender, but in general, you’ll need a credit score of at least 620. Higher scores will net lower interest rates. For LTV, most lenders want to see 85% or lower. When it comes to DTI, lenders typically require a ratio of 36% or below, though some may accept a higher percent. In combination with DTI, lenders usually want to verify a stable income source.

- Home equity loan: This loan option offers a lump sum of money at the beginning of the loan term. The interest rate, and monthly payment, will stay the same throughout the loan’s term. Since it is also a loan, qualification criteria for a home equity loan will be the same as those for a HELOC. It’s important to understand that with both a home equity loan and a HELOC, you are borrowing against your home. In other words, you are using your home as collateral. If you are unable to make your payments, you can run the risk of foreclosure and losing your home.

- Cash-out refinance: In a cash-out refinance, you’ll take out a whole new mortgage. The idea is to obtain the mortgage for more than what you owe on your home. Then you pay off your existing mortgage and keep the difference in cash. To qualify, most lenders require a credit score of 620 or higher, DTI of 43% or less, and verified income. The process, paperwork and documentation requirements are the same as when getting a first mortgage. With mortgage rates significantly higher than they were a few years ago, it does not make sense for homeowners who were able to secure a low rate to give that up for a higher rate. So, unless you bought a home very recently – at a high rate – a cash-out refinance likely is not the best option to tap your equity.

- Reverse mortgage: If you are 62 or older, you may consider a reverse mortgage. In this type of loan (it is still a loan), the lender makes a monthly payment to you instead of you making a monthly mortgage payment to the lender. In so doing, with each payment, the lender receives an increasing amount of your home’s equity. A reverse mortgage ends when the home is sold or when the homeowner passes away. The loan would need to be paid back sooner if you fall behind on any property taxes or insurance premiums, or let your home fall into disrepair. A reverse mortgage also ends if the homeowner moves out for a year or more – for any reason.

While there is no income requirement for a reverse mortgage, homeowners must pay closing costs, which are often higher than those of traditional mortgages, as well as origination fees, loan servicing fees, monthly mortgage insurance premiums and an upfront mortgage insurance premium. They’re also required to complete a federally approved counseling session (for a nominal fee).

Other options to access home equity

Our survey found that more than 4 in 10 U.S. homeowners (42%) said they would consider accessing their equity if it were possible to do so without a loan or taking on another monthly payment. The good news is that a home equity agreement (HEA) offers that option.

- Home equity agreement (HEA): An HEA, sometimes also called a home equity sharing agreement or home equity investment agreement, is a way to access home equity without monthly debt payments. With an HEA, you receive cash up front in exchange for a portion of the future value of your home. You settle when you sell your home or anytime during the term of the agreement, usually 10 to 30 years. Qualification requirements are typically more accommodating than those associated with a home equity loan or cash-out refinance. In fact, credit scores as low as the 500s may qualify. Because there are no income requirements, an HEA is a useful alternative for self-employed workers and retired homeowners, who may have fluctuating or limited income.

Home equity: A bright spot

Home equity is a bright spot in an otherwise-uncertain housing market. If you are in need of cash – for home improvements, paying off debt, building your emergency fund or other reason – the good news is that you have several options to tap your home equity. You’ll need to carefully research each alternative to see what works best for you. If you are more comfortable without taking on additional monthly debt payments, an HEA might be an ideal option. Learn more about how Unlock’s HEA works.