Ready to tap into your home’s equity? Great! Here’s a simple guide to help you navigate the application process for Unlock’s home equity agreement (HEA).

Apply in Four Easy Steps:

- Create a secure account: Start by answering a few questions about your home.

- Approve a soft credit check: This won’t affect your credit score.

- Fill Out Your Application: Provide some details about your home and sign the application—no obligations, no strings attached.

- Upload a Few Documents: We typically need your ID, mortgage statement and proof of homeowners’ insurance.

Get an Estimate

In just a minute or two, you can get an estimate of how much cash you might be able to pull from your home.

Begin by creating a secure account with your email and a password of your choice. To give you an accurate estimate, we’ll ask for:

- Your Property Address

- Type of Property: Single-family home, townhouse, condo, etc.

- How You Use the Property: Is it a primary residence, a second home, or an investment?

- Property Value: We generate a default estimate, but you can adjust that figure as needed.

- Outstanding Debt on the Property: This includes your remaining mortgage and any home equity loans.

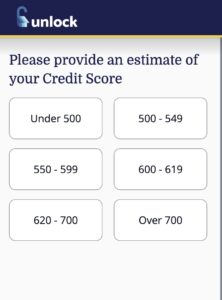

- Estimated Credit Score: You can pick from a range of scores rather the citing an exact score. The photo below shows the credit score range options.

- Your Name and Phone Number. Don’t want to provide your number? You can always call us directly at 1-800-560-3450 to continue the process.

You can view your estimate securely online. Although the process is fully automated, you’ll have a dedicated home equity officer to guide you whenever needed.

Complete Your Application

Once you’ve reviewed your estimate and are ready to proceed, click “Next” to start your full application.

During the application, we’ll ask for your Social Security number to perform a “soft credit check” to verify your credit. This doesn’t impact your credit score and is only visible to you.

Other details we’ll need include:

- Trust Ownership: If your property is held in a trust.

- How You Plan to Use the Funds: Pay off debt, home improvements, etc.

- Home Purchase Details: When you bought it and for how much.

- HOA Fees: If applicable.

- Private Mortgage Insurance (PMI): And any other monthly property expenses.

- Existing Mortgages: If you have more than one.

- Mortgage Delinquencies: Any recent 90-day or 120-day delinquencies.

- Bankruptcy, Foreclosure, or Short Sale History: In the past 10 years.

- Outstanding Judgments or Past-Due Taxes: Or if you’re in a mortgage repayment or foreclosure mitigation program.

Upload Your Documents

We’ll need just a few documents:

- Government-Issued ID: A driver’s license, passport, or Green Card. Simply take a photo with your phone and upload it.

- Homeowner’s Insurance Declaration Page(s): This should show the name on the policy, policy period and replacement cost details. For condos, the master policy is sufficient.

- Mortgage Statement: Make sure it lists your current balance, payment history and interest charges. If you don’t have a mortgage, you can skip this.

- Home Equity Loan/Line of Credit Statements: If applicable.

- Lease Agreements or Proof of Rental Income: If you rent out the property.

- Trust Documents: If your property is in a trust.

If we need anything else, your home equity officer will reach out.

Review and Sign Your HEA

After you complete your application, we’ll verify everything and send you an estimate with detailed terms and costs.

If you have everything ready, the whole process—creating an account, getting credit-qualified, completing the application, and uploading documents—should take about 15 minutes.

Remember, you can always call us if you have questions at 1-800-560-3450.

The blog articles published by Unlock Technologies are available for general informational purposes only. They are not legal or financial advice, and should not be used as a substitute for legal or financial advice from a licensed attorney, tax, or financial professional. Unlock does not endorse and is not responsible for any content, links, privacy policy, or security policy of any linked third-party websites.”