Key takeaways:

- Home prices have softened and may decline more.

- That’s generally bad news for homeowners, who now have less equity than they did before.

- This is a good time to explore your options: talk with a real estate agent or consider tapping home equity.

If you’re a homeowner, you probably know all too well that the housing market has softened – a lot. Home prices have even slipped, according to a few measurements. And they might fall even further. That’s probably not what you want to hear, but there are some steps you can take now to protect your investment and understand your options.

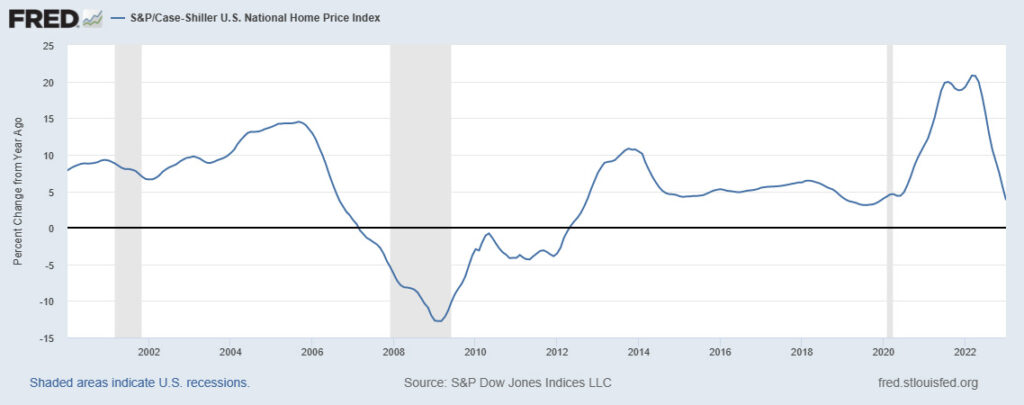

It’s worth noting that there are dozens of popular home price trackers offering slightly different results. Some compare prices of properties that sold during a particular period, some compare prices of homes newly listed on the market, and so on. The closely watched index sometimes referred to as “Case-Shiller,” shown in the graph below, is notable for reporting data via a rolling three-month average.

The outsized demand for housing created by the COVID-19 pandemic pushed prices upward, in many cases by double digits compared to the year earlier, for months on end.

But that was unsustainable, and when the Federal Reserve began to raise interest rates, mortgage rates followed. Many house hunters, as motivated as they may have been, simply couldn’t afford the monthly payment for more expensive homes and pricier mortgages.

Now, one year into the rising-rate regime, home prices have responded. Many housing experts expect more of the same in the months ahead. The good news is that if you owned your home before the pandemic run-up in prices, it’s still probably worth more – a lot more, in fact – than it was before COVID. (In February 2020, the national median home price was $270,100; in February 2023, it was $363,000, a 33% increase in just three years.)

All that means that your home value – and, by extension, your home equity – isn’t likely to grow much in the near future. As a reminder, home equity is the amount your home is worth minus whatever you owe to a bank or other mortgage lender.

What’s more troubling is that many economists also expect a recession to hit later this year. That would mean more people out of work, fewer people interested in buying homes, and banks more reluctant to offer mortgages. That’s not a good cocktail for the housing market.

If you have no plans to move or to upsize, downsize or make other major life changes, this shouldn’t concern you. Real estate is a long-term investment, and over time your home equity will bounce back.

But if you have been thinking about trying to move, now might be a good time to consult a local real estate agent or two. There are a lot of variables to consider. Even if you’re able to sell your home for the price you want, for example, will you be able to afford a higher mortgage rate on a new property?

The math is a bit more straightforward if you’ve been thinking of tapping your home equity for any reason – a tuition bill, a home renovation, paying off expensive debts and more. Now is probably the right time, considering your home value might not get much better, at least for the foreseeable future.

The blog articles published by Unlock Technologies are available for informational purposes only and not considered legal or financial advice on any subject matter. The blogs should not be used as a substitute for legal or financial advice from a licensed attorney or financial professional. Links in our blog posts to third-party websites are provided as a convenience and are for informational purposes only; they do not constitute an endorsement of any products, services or opinions of the corporation, organization or individual. Unlock Technologies bears no responsibility for the accuracy, legality, or content of external sites or that of subsequent links.